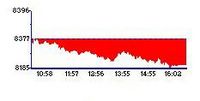

Post 9000 ! Beware of Speed Breakers

Indian Stock markets got to taste the speed-breakers after zooming past the 9000 mark.

The sensex shed 170 pts. and nifty 55 pts. in a landslide fall. Huge selling was seen across the counters with investors seen cashing on to their gains of previous days. The Mid-cap and small cap index also fell by 2% each.

The current Scenario

Yesterday's selling can't be termed as abnormal. In a rising markets , bouts of profits bookings are a common phenomenon. However, to add spice to the fall was the unwinding of the December derivatives and the uncertainty on the Reliance post demerger scenario.

FII's have slowed down their pace of investments and the overall outlook for extreme short term has become bearish. FII's are also in holiday mood. The week ahead may see some more volatility.

Investment Guru's Outlook

Investment guru recommends investors to maintain their bullish outlook on the long term Indian Story. These downfalls are bound to happen in a market that is charting new territories. These downfalls should actually be used to build up positions in good stocks which are unnecessarily battered and hence will bounce back with improvements in sentiments.

Happy Investing!

Read More!

Investment Idea : Aksh Optifibre Ltd.

company : Aksh Optifibre Limited (AOL)

CMP: Rs. 74

Short Term Target : Rs. 90 (2-3 Months)

Long Term Target : Rs. 120 (12 months)

Investment risk : Moderate

About the Company

Aksh Optifibres Limited is the second largest player in the Optical Fibre Industry. The company is mainly into manufacturing of Optical Fibres, OF Cables and FRP Rodes.

The company boasts of being the only company in the whole industry to manufacture OFC through co-extrusion process.

The company caters to the need of Telecom sector. In view of the strong Telecom growth story, AOL should gain immensly and should be able to turnaround its operations.

The company is undergoing a major expansion of its production capacity to cater to the growing demand of its products. The capacity expansion is estimated to be in tune of 50%.

The company is also undergoing a debt restructuring by transforming the high rate debt components to lower rate debts. This restructuring will show up on the improved margins of the company.

Turnaround to boost valuations

The capacity expansion and cost reduction initiative embedded with the strong industry outlook has made Aksh Optifibre a strong Turnaround candidate.

The company incurred a loss of Rs.3.24 crores in the last year on a turnover of Rs. 38 Crores. However, this year in six months only, the company has achieved a turnover of Rs. 47 crores and a profit of Rs. 8 crores. This gives a clear indication that the company is out of the blues and is on the verge of turnaround.

The company's order book is strong at Rs. 86 crores and is expected to swell further @ 50% given the strong demand for its products.

The stock is also recommended for a long term position since the real fruits of the performance will be available in FY07.

(Disclosure: Investment Guru has a position in the Investment Idea discussed. Investors are advised to use their discretion and read the disclaimer clause before acting on any recommendation discussed on this blog) Read More!

Update on Narmada Chematur

You can re-read the article on Investment Idea by Clicking Here

The stock was recommended at a price of Rs. 38 with a time frame of 12 Months and a target of Rs.70

The stock reached a high of Rs. 49.85 after the recommendation , however, fell down to Rs. 34 after the news of the merger.

GNFC is the promoter of NCPL and if the company is mulling a merger of NCPL to itself, I do not see it a s a setback to NCPL. Also, the announcement says that a merged possibility is being explored. Since the idea is at its initial stage , it would be difficult to predict what the management finally decides and what will be the swap ratio for the merger.

Looking at GNFC, with whom the company is getting merged, the financials looks good. The company has posted a 40% jump in the net profit in Q2 of this year. Even NCPL has registered good results. At this stage, Investment Guru is of the view that the merger may create synergies for GNFC and in turn should be eventually good for the shareholders.

However, it terms of share prices, a lot depends on the swap ratio for the merger.

Investment Guru is of the view that investors should hold on to the stock and watch for further developments in terms of the merger. The blog will keep you updated with any change in the outlook for the stock based on further developments. A new target price would be published on the blog once further visibility comes to the development on merger.

Happy Investing !!

Read More!

AGB Shipyard : Will history repeat itself ?

ABG Shipyard has eneterd the capital markets with an offer of 85 Lac shares at a price band of Rs. 155-185. This IPO reminds of the Bharti shipyard IPO which was offered at Rs. 66 and is currently trading at Rs. 338. SO the question arises , Will the History repeat itslef ? Can ABG repeat the Bharati story ?

Investment Guru analyse the IPO and answers the above question too.

What makes this IPO attractive ?

1. The shipyard industry is in limelight and has attracted investor attention. ABG will not be an exception to this.

2. The company is the largest private sector shipyard in India. It builds marine ships, including bulk carriers, deck barges, interceptor boats, anchor handling supply ships, driving support ships, tugs and offshore vessels.

3. It has built over 88 ships since its inception in 1990, and currently has an order book position for 27 ships under construction. The comapny's order book is worth Rs.1300 crores and 50% of this is from exports.

4. The Issue price at upper band of Rs.185 comes at a PE multiple of around 14 (considering annualised EPS of Rs. 13). However at wieghted average EPS of last three years, the issue comes at a PE of 17. The Bharati shipyard stock is currently trading at a PE of 25.

5. The company expeansion plans to set up a new shipyard at Dahej will start bringing fruits in another 3-4 years and hence the stocks looks good even from long term perspective.

6. The weighted average return on networth is to the tune of 33.8%

Concerns :

The company is running at 100% utilisation of its facilities. The time lag between the usage of the new facilities may show up on the returns of the company.

Since the company has a good share of export earning, competition from other countries like china may have impact on future earnings.

Investment Guru's Outlook on the IPO

Investment Guru recommends investors to apply for the IPO. The IPO will certainly not repeat the history of Bharati Shipyard. The reason behind this is that the Bharati IPO was priced quite conservatively and hence provided spectacular gains to Investors. This is not the case for ABG shipyard. The company has certainly left something for Investor but it is not copmarable to Bharati IPO. Given the small size of the IPO, one need to have lot of luck on his side to get allotment. The small size but huge apetite scenario will also lead to smart listing of the stock.

The IPO can also be used as a entry for long term investment in the stock. The shipyard sector is at the upward trend of its cycle and there are no near term concerns of its moving to downtrend.

Issue Opens: 18-Nov-2005

Issue Closes : 24-Nov-2005

Registrar :Intime Spectrum

Read More!

Investment Guru's Trading Blog

Investment Guru presents you a blog which focusses on stocks with Trading perspective.

This blog will carry trading recommendation on regular basis and follow-up on them.

The blog also covers stocks which may see action during the day, however these will not carry any target price.

As all of us know that Indian stock markets do have lot of opportunities for traders and this Blog will help traders to cpaitalise on such ooportunities. As always please use your discretion in using the trading opportunities discussed.

The idea behind creating a new blog was to differentiate trading with Investing and avoid confusion among visitors. Investment Guru Blog continues to provide you Investing Opportunities while the Trading Insight Blog provides you insight to the Trading opportunities.

The advice to visitors o the new blog would be to first keep a watch on the blog and see how the trading ideas and other info on the blog performs and once you generate a confidence and align yourself to the communication on the blog, you may decide to follow it.

Wish you happy Trading !

Go to Trader Insight Blog

Read More!

IPO Update : Bombay Rayon Fashions

Bombay Rayon is entering the capital markets with a issue of 134.75 Lac shares to be issued at a price band of Rs.60-70.

Investment Guru recommends investors to apply for the issue with an objective to encash LISTING GAINS. Though the issue looks priced a bit aggresively , it is in line with other IPO's and one expect a listing gain in the range of 15-20% (subject to market conditions on listing) on the issue price.

Company Highlights :

The company is engaged in export of fashion fabrics and garments

The proceeds of the issue will be used for the expansion of capacity and working capital.

The book value as on June 30, 2005 is Rs. 15.43 per Equity Share.

The company clocked a net profit of Rs. 7 crore for FY05 on sales of Rs. 127 Crore.

EPS for FY05 stood at Rs.7.57 which converts into a P/E multiple of 9

The Return on networth for FY05 stood at 16%

Exim Bank holds a 5% (pre IPO) stake in the comapny, bought at a premium of Rs. 40 Per share.

Registrar : Intime Spectrum

Issue Opens : 11-Nov-05

Issue Closes: 17-Nov-05

Read More!

Reliance Industries : Built to succeed

The Reliance Industries stock has been in the limelight for past few weeks.

The shareholders and creditors of Reliance have recently okayed the demerger scheme with overwhelming response.

Under the scheme of arrangement, finalised in broad detail in June this year, Reliance will transfer its holdings in Reliance Capital, Reliance Energy, Reliance Infocomm and Reliance Communications to four new entities promoted and controlled by Anil Ambani. RIL shareholders will get shares in the four entities.

SHAREHOLDING IN DEMERGED ENTITIES

All shareholders of RIL, except the Specified Shareholders', would be issued shares of de-merged undertakings in 1:1 ratio i.e. for each share held in RIL, shareholders would get:

1. One share of Reliance Communications Ventures Ltd. of face value Rs. 5 each fully paid-up

2. One share of Reliance Energy Ventures Limited of face value Rs. 10 each fully paid-up

3. One share of Reliance Capital Ventures Limited of face value Rs. 10 each fully paid-up

4. One share of Global Fuel Management Services Limited of face value Rs. 5 each fully paid-up

The Specified Shareholders i.e. Trustees of Petroleum Trust (holding 7.5% of RIL) and four companies - Reliance Aromatics and Petrochemicals Pvt. Ltd., Reliance Energy and Project Development Pvt. Ltd., Reliance Chemicals Pvt. Ltd. and Reliance Polyolefins Pvt Ltd (collectively holding 4.7% of RIL) hold RIL shares for the economic benefit of RIL shareholders. The Specified Shareholders will not take shares of the resulting companies. The RIL shareholders will get proportionate benefit of this also. As a result thereof, the total number of shares to be issued by each of the resulting companies would be 122 crore as against 139 crore equity shares of RIL.

BENEFITS TO SHAREHOLDERS

The shareholders of RIL would continue to participate in the growth and progress of RIL, which is a global oil, gas, refining and petrochemicals company. They would continue to hold the same number of shares as they currently hold in RIL. In addition to that, they would receive separate shares in the four demerged entities, which will allow them to participate individually as well as collectively in the growth areas of telecom, financial services and coal and gas based energy businesses. The shares of the resulting companies will be listed on the Stock Exchanges in India, where RIL shares are currently listed, thus providing liquidity to all shareholders. This will unlock value for all shareholders as they can participate directly in all the businesses that RIL has nurtured and brought to stature.

Outlook on Reliance

Investment Guru believes that the demerger should unlock the value for the Reliance Industries Sharholders and the total value of their holdings in the demerged entities should be quite higher than the current market price of the Stock. The street is buzzed with expectations that the premium will be in the range of Rs. 200-300 on the stock post demerger.

Next on Investment Guru:

IPO Update on Bombay Rayon Fashions

Read More!

Back to the Blog...

You must be wondering where I was for last three weeks , with no updates on the blog. I would say it was a mix of a pesonal and official work pressures which kept me away from the Blog. The blogger in me was quite eager to go back to the dashbopard and start writing , but circumstances prevailed.

However, when you see my post , you can make out that I am out of the woods now and ready to blog again with same spirits!

I thank all the visitors for their patience to see the blog not updated every time they looged on to it for last three weeks and still maintaining their faith in this journey of successful investing !

So let's take about investments and here follows my next post...

Happy Investing !! Read More!

Sothern Online Biotech -Allotment

Finally, the allotments have come. The listing strategy should be to sell on the listing day.The stock is expected to list in the band of Rs.14-18 on BSE which should be a decent gain for the investors on the issue price.

Happy Investing !! Read More!

Bears take Bulls by horn, Sensex down 80 Pts.

The last hour of the trading today proved that bears were in strong hands. The sensex which opened on a positive note and went on to a high of 100 points in the intra day from its previous close finally slipped to the red and closed down 80 pts.

The market breadth turned weak in the latter part of the trading session. 1,621 stocks declined on BSE as compared to 773 stocks that rose. 42 scrips were unchanged. Losers outpaced gainers by a ratio of 2:1.

Ranbaxy emerged as Top loser and the scrip closed at Rs.412 with volumes of around 7 Lac shares. Other pharma scrips followed suit.

In metals , TISCO lost 5% to close at Rs.346. Same was the case with tech stocks. Stalwarts like Reliance and Gujarat Ambuja closed with losses.

Outlook for Wednesday

Tuesday's fall is significant with the perspective of the market sentiments. With markets rising in the morning, investors were expecting a sort of turnaround for the stocks. However, that proved to be elusive in the last hour of the trade.

The market breadth has turned quite negative. The only solace is that the volumes were not so high as compared to Monday.

However, alot depends on how the markets move on Wednesday. The outlook for wednesday is weak and the selling is expected to continue. Investors are advised to stay cautious. Read More!

Sensex melts on selling spree; down 289 pts.

The Indian Stock markets witnessed a selling spree this week resulting in the Sensex melting by 289 points. Heavy selling was seen from FII's who chosed to book pofits in the month of October to inflate their books and bank on good bonuses for the year-end party.

What has changed for the markets ?

Few new scenarios have come into picture. First and foremost is the talk about reallocation of FII funds to the emerging markets in the month of January. The street is aloud with the news that FII may reduce their allocation in the Indian markets and move some money to other markets such as Japan.

However, from the fundamental perspective, nothing has changed in the Indian story. The Q2 earning season started on a good note with Infosys increasing its guidance and outperforming the street expectations. However, the judgement in Lipitor case went against Ranbaxy and bought doom to the pharma scrips.

Mutual Funds: What are they doing ?

Mutual funds remained net buyers and helped the sensex to save itself from further meltdown. The reason being that some of the mutual funds have garnered huge subscription from their recent offerings and they have to invest the same in the Indian equities. Mutual funds are using these dips to enter at better levels.

Who are worst effected?

Those investors who have invested in equity markets in last two months are the worst effected from this meltdown. However those who are invested since last 6 months are quite better off though they too had dint in their profits

Has the long term outlook on India Changed ?

Absolutely not. Though the markets may see some more downfall before moving up, the long term scenario of strong bullish sentiment still remain intact.

Advice to small Investors

Investment Guru advice the investors not to panic under these situations. This is an outcome of the liquidity movements and hence will not impact the long term investors. When the FII's do the reallocation in Janaury, Indian markets will again see huge buying from them.

Investors are advised to have a long term outlook while buying stocks. Those who are sitting in cash are advised to use such dips to slowly start buying in stocks which have good fundamentals but are battered by this meltdown.

Investment Guru blog will continue to guide you in your journey to Investing.

Happy Investing ! Read More!

IPO Update: Paradyne Infotech

Paradyne infotech has entered the capital markets with a offer of 33 Lakh shares at a fixed price of Rs. 42 per share.

The object of the public offer is to expand the existing operations, product upgrades and setting up data and support center.

Paradyne is an existing profit making, dividend paying Company engaged in the business of computer software, system integration and managed services. The system integration stream contributes around 70% to the topline.

For FY05, the company posted net profit of Rs.5 crores on a turnover of Rs.69 Crores.

The EPS of the company for FY05 stood at Rs. 6.60 which translates into P/E of 6.36 at the offer price of Rs. 42

Investment Guru is of the opinion that in view of the bullish market sentiments and strong IPO listing patterns, one can consider investing in the IPO with a view to encash the listing gains. Read More!

IPO Update: Suzlon Energy

Suzlon, Leave something for Investors !

Suzlon energy has entered the capital markets with an issue of 2.93 crore shares of Rs. 10 each at a price band of Rs.425 – 510.

Investment Guru is of opinion that the issue is priced very aggresively by the company and hence lefts very less on the plate for Investors from fundamental prespective. However, with IPO boom going on in the markets it would not be a surprise if the issue rolls out some listing gains. Those who are interested in applying are advised to apply maximum of two times their expectation of allotment. From valuation perspective, the issue is worth avoiding.

However from the subscription patterns till date, there has been huge subscription from FII”s. Retail Investors are missing from the show and against an allocation of 86 Lac shares, applications for only 92,000 shares has been received.

Let’s Dig into the company:

The object of the issue is to fund the expansion plans, capitalisation of subsidiaries, construction of new corporate office, Redemption of preference shares and exploring growth opportunities.

Suzlon is a Total wind power solutions company. The company is India’s largest in its class and ranks among top ten in the world.

The company clocked a turnover of 1965 crores durting FY05, registering an increase of 125% over previous year.

The net profit of the company stood at 365 crores for FY05, a 151% increase over pervious year.

The issue comes at a FY05 P/E of 34. If we take the weighted average EPS of last three years, the issue comes at a P/E of 52.

The company considers companies like ABB, Siemens, BHEL and NEPC as its peer and the the peer Group average P/E comes to 29.

The company has Book Value of Rs.93 per share. Hence the issue comes at 5.48 times the Book Value.

Registrar: Karvy

Issue opens: 23-Sep-2005

Issue closes: 29-Sep-2005

Senxex trades weak, Fundamentals Intact

The sharp fell in the stock markets witnessed yesterday resulted in panic selling among investors. The markets opened today on a positive note, however that was shortlived. Soon the sensex dipped again to Red. It is true that in this wave of correction in small and midcap stocks, many good stocks also took the beating. Even large cap stocks came under the fire.

Let's see what have changed in the last few days. I do not find anything missing except the momentum and hence those stocks which were running just on momentum and didn't had any fundamentals to justify their momentum fell like nine pins.

It's important for small investors to avoid a temptation of making fast bucks and buy stocks on hearsay.

However, the silver lining is that those investors who are sitting on cash and waiting for the markets to correct will find some opportunities to enter the markets at lower levels. The long term sentiments is still bullish.

Stocks which look good pick for Investments include Gujarat Ambuja, Hindalco, Reliance Industries, Moser Baer, Dishman Pharma, Allahabad Bank and Jindal Viaynagar

Happy Investing !

Next on this Blog:

IPO Update :Southern Online

Read More!

Markets taste Freefall, Sensex dips by 265 Pts.

The sensex had a free fall today ! Selling was witnessed acrosas the caps and stocks. The market breadth looked negative with huge selling acroos the markets.

The free fall has come after Sebi and regulatory authorities sending warning signals on the way markets was approaching to higher levels. Filters have been revised on a whole lot of small and mid cap srtocks and many stocks have been put to Trade to Trade segments.

In one way , the crash cab be termed as healthy sign for the markets. This will help protect small Investors being ruined of thier precious money by investing in unknown penny stocks.

Investment Guru recommends smart Investors to make use of this opportunity to invest in some good counters which have also come down in line with market sentiments.

Tomorrow's trade will be crucial as funds may start buying selectively in value stocks, while continued selling is expected in most of the mid caps and penny stocks.

Read More!

FCS bucks the Trend

Many of the investors were taken aback today to see FCS software ruling at Rs.199 on the bourses. It is the only IPO after the Impex Ferro which has shown such a jump. This shows the frenzy among the buyers for the IPO's on the listing day. Anyway, on the other hand it is good opportunity for those who got allotment. Investment Guru advice traders to be cautious as the stock may become more volatile during the day. Read More!

FCS Software -Listing Strategy (Sep. 21)

The stock is expected to list ion the range of Rs.80-90. Investors are advised to book profit on 50% of their stock position within first 2 hours of trading. For the balance , it is advised to watch the demand-supply pattern for the stock. Recently listed IPO's like Amar remedies have shown good strength and the momentum seem to continue.

With lot of volatility seen on listing days, I would avoid trading in the stock , however , investors ready to take risk may short over Rs.100 levels to cover up during the day. Similarly , a position can be built in the stock at around Rs. 70 levels to set off at higher levels during the day.

Wish all the visitors happy listing and smart money tomorrow!! Read More!

Investment Idea : Gujarat Ambuja Cement Ltd.

CMP : Rs. 73

Target Price: Rs. 105

Time frame : 6 Months

Risk : Moderate

Investment Guru recommends to consider investing in Gujarat Ambuja Cement at the current levels. The Cement Sector is poised for strong growth both in terms of Volumes and price. The demand for cement is expected to inch up with infrastructure companies bagging large infrastructure projects. The price of cement bags is also expected to go up by Rs. 5-7 . This will help the cement companies grow both the top line and bottomline.

Gujarat Ambuja with its strong brand presence would be a beneficiary of the infrastructure boom.

Happy Investing !!

(Please read the Disclaimer clause before acting on any Investment Advice on this blog) Read More!

Investment Idea-3 exceeds Target !!

Investment Guru recommends Investors to hold on to the stock. The Target for the stock is now Revised to Rs. 90 with a time frame of 1 year.

Happy Investing !!

The Next Investment Idea is coming soon on Investment Guru Blog Read More!

Add yourself to Investment Guru Database

As a part of our exercise to provide better reach to Investment Guru Updates, we are creating a database of our visitors. You are requested to drop an email with following details :

Subject : Add me to Investment Guru Database

Your Name

City

Country

Send you email to investmentguru@sify.com

As you may be aware that the blog will undergo some restructuring in few weeks to enhance its potential and reach to the visitors.

All visitors who add themselves to the database will get exclusive access to premium contents on the blog.

Happy Investing !!

Coming soon on Investment Guru Blog

Investment Idea #7

Read More!

Investment Guru rules - Spice jet reaches Target !

The stock was recommended on this blog at a price of Rs.63 with a three months time frame and a target price of Rs.90. The stock is currently qouting at Rs. 115. This gives a absolute return of 83% in just 3 months.

Keep a watch on the blog for more Investment Ideas !

Happy Investing!! Read More!

IPO Update : TAC Ltd.

Talbros Automotive Components Limited is coming with a second public offer aggregating Rs. 50 Crores. The issue comes at a price band of Rs. 90-102 per share. The Share of the company is currently trading on BSE at Rs. 138. The stock has hit a 52-week high of 349 and a low of Rs. 60.

Investment Guru recommends investors to apply in the public offer. However, investors with eye on listing gains are advised to keep their expectation low as the money on the table is already visible and the stock price is expected to come down on listing. Investment Guru is of view that the offer should give a return in the range of 20-25% on its issue price. From long term perspective too, the stocks looks good at the offfer price.

Let’s dig into the company:

The objective of the public offer is to fund the setting up of forging plant at Faridabad to meet internal requirements.

The investment is in joint venture with Nippon Leakless Corporation, Japan for catering mainly to Honda group of companies within the country

The promoters are also investing in the public issue, which is a good indicator.

The company is the largest exporter of Gskets.

The clientele of the company includes Tat Motors, Ashok Leyland and swaraj.

The company is a profit making company since 1959 and has a dividend track record for 48 years. The last dividend declared was 20%.

The company has made six issues of Bonus shares till date. The last bonus isse of 5:2 was made in Dec.2004.

The major competitors of the company are Banco and Victor Gaskets.

The offer comes at a multiple of 3.66 times the Book value of the company.

For the quarter ended June, 2005, company has clocked sales of Rs.29 crores and a net profit of 1.59 Crores

Issue opens : 01-Sep-2005

Issue Closes: 09-Sep-2005

Registrar : KarvyComputershare Pvt. Ltd.

Mode : 100% Book Building

Coming soon on Investment Guru :

Does the Sensex makes Sense ?

The stock markets are booming with index touching new highs. The rally is spread acrss large , mid and small caps. How should a small investor approach the markets at this juncture? Should sensex be taken as a guide for making investment decisions?

Watch out for a crtical analysis of the sensex and the stock movements and the investment policy to be adopted in a bull run. Exclusively on Investment Guru Blog !

Read More!

Investment Idea 5 reaches its target !!

Cheers ! Read More!

IPO Update: Amar Remedies

Amar Remedies has entered the capital market with an offer of 1.5 crore equity shares through 100% book building process in the price band of Rs 24-28 per equity share of Rs 10 each. The object of the issue to set up a Ayurvedic institute at Surat.

Investment Guru recommends investors to apply in the IPO. The objective should be to offload on listing. Long term Investors can hold on to the stock with a 2 years perspective to generate the real potential of the stock.

Let’s dig into the company :

The company was established in 1984 by Mr. P. Shah for developing Ayurvedic Medicines.

The company has three products at present in its portfolio with Tooth Paste segment as a major contributor. The company markets its product under brand name “AMAR”

The company cliams to produce the first Vegetarian Toothpaste.

The company has regional market share for its products mainly in Wester and eastern parts of India.

The company has ambitious plans to launch its 25 FDA approved Ayurvedic medicines in India as well as in International markets. However, the market for Ayurvedic product is dominated by niche players and the company would have to staisfy with second grade buyers for its products.

The company is a profit making company since 1995.

The company clocked revenues of 106 crores for the year ending 30-June-05 with a net profit of 6.87 crores. Net profit was up 89% compared to previuouys year, while the sales shoot up by 29%.

The pre issue EPS stood at Rs.6.16. However, post issue the EPS would come down to 2.63.

The issue comes with a post-issue P/E of 10.6 which looks reasonable given the ambitious expnasion plans of its product portfolio.

Issue opens : 25-Aug-05

Issue closes : 31-Aug-05

Read More!

IPO Update : FCS Software Solutions Ltd.

FCS has entered the primary markets with a public offer of 35 Lac shares @ Rs. 50 Per share (a premium of Rs. 40 on face value of Rs. 10 )

Investment Guru recommends investors to ride on the IPO wave and apply for the IPO to get listing gains. The IPO is expected to generate listing gains in range of 30-50% mainly due to the IPO boom going on in the markets. Another reason being low float that will lead to good listing. Other factor is that 50% of the issue will be alloted to retail investors and this may also lead to spurt on listing day in the price of the stock.

The company has released limited applications resulting in scarcity of the application forms for this IPO.

About the company

FCS claims to be a leading provider of IT services. However the company can be termed to be a small player in the software service consulting space. The company is into fields of E-learning and digital consulting, IT Consulting, Product engineering services and application support.

The issue proceeds will be use to create IT infrastructure to for addding 300 software developres.

The company is promoted by Dalip Kumar , who looks reasonably qualified to take on the company, however, does not have any big feather in his cap.

The company has declared 0.25% dividend during last five years

The company is heavily dependent on US for its business and hence any negative turn of events in US directly impacts its revenues, for example the Sep11 blasts made a big dent in the performance of the company in year 2002-03.

Being a small player in a business which gives preference to the large players , the company would have tough competition in order to grow itself.

The offers comes at a P/E of 6 which looks reasonable and hence offers a scope for listing gains for investors.

Issue Closes : 26-Aug-2005.

Read More!

The Third Eye: Mphasis BFL

The stock saw a dip of Rs. 20 after the news that the bid for Barings stake may be around 260 per share. However with rumours of Tata back in action, the stock may see some volatility. The stock looks good for day trading . Read More!

Stock Markets : The Road Ahead

Outlook on markets still positive

The markets are expected to remain volatile with upward bias with short term perspective. The long term movement also looks positive. However , small bouts of corrections are not ruled out.

The biggest factor for markets to remain buoyant is that there is enough liquidity in the markets. The FII's continue their buying spree acrosss the caps and sectors. The Indian stock markets are seeing an unprecedentedt trend with large money flows chasing stocks and trying to find out value among underperforming stocks.

Retail investors have also flocked in large numbers to try their luck and get some pie in the stocks. The number of Demat accounts opened in last month has crossed the 2 Lakh marks. Retail investors are still betting on the IPO's as the main entry gate to the stock markets . With slew of IPO's lined up to hit the markets and retail interests intact, the IPO's are poised to do well and bring wealth to the investors.

Which sector will perform well from here ?

The Banking space is expected to perform better with private banks taking a lead over their public counterparts. Technology sector has remained an underperformer with no fresh triggers , however , positive news on the bell weather stocks and acquisition plays may create interest in the sector. This sector is expected to be a performer. Metals remain sluggish and are expected to be same with short term perspective. Oil & Gas sectors are expected to be market performer. Textiles will also continue to attract buyers.

Investment Strategy

It is recommended to keep the IPO investment route intact. Fresh buying in the stock markets should be done only on selective basis and not on rumours. Stick to the fundamentals and growth stories. Beware of small cap stocks which have run up quite high and do not let greed overtake the senses.

vivimed explodes on listing !

Investment Guru recommends those fortunate investors who got allotment to book partial profits at Rs.200 levels and wait for tomorrow for rest of the holdings to test the waters.

Happy Investing !! Read More!

Investment guru rules !!!

The stock was recommended at Rs. 63 and is now qouting at Rs.90, a cool return of 43% in just 3 months !!!

The stock is in news following talks of interest shown by Hinduja group in buying a controlling stake in the company.

Keep a watch on the blog for may more Investment Ideas to come.

Happy Investing!! Read More!

IDFC : Listing with a Blast!!

Over 10 crore shares have been traded in just 30 minutes of trade.

The stock has seen huge buying since the stock is recommended for a long term excellent returns. .However, looking at the listing,it looks like that even the listing gains are not bad.

Investment Guru recommends investors to garnet the listing gains on 50% of thier holdings @ Rs. 69 and keep the balance to see if some firework is left in the stock.

We will get an opportunity to get back the stock at a lower levels than today in the coming days.

Happy Investing !! Read More!

IDFC Ltd. – Listing Strategy

Expected Listing : Rs 45-50

The IDFC stock is getting listed on 12th August on NSE & BSE.

The issue price was Rs. 34 per share.

As I have already mentioned in the article on the recommendation for applying in this IPO, this stock is a good long term bet. Click here to see the article..

Following is the strategy that can be adopted by different investor groups:

For those intrested in listing gains : If the stocks lists around 45,you can book profits on 50% holdings and wait for day 1-2 to sell the ramianing shares.

For short term Investors (2-3 months) : Sell 50% on listing and hold the rest for 3 months duration.

For long term Investor: This group is going to benefit maximum out of the stock. Investor Guru recommends investors to maintian a long term hold on this stock for excellent returns (much more than the listing gains!)

Risk Factors :The risk factor for a good listing tomorrow is the big float of the stock. It was a large issue, hence the supply of the stock will be in huge quanitities tomorrow. This may lead to volatility in the stock after a initial good listing. Investors should devise their strategy accordingly.

Happy Investing!!

Read More!From the Pinkcity....

Though I am spendingmostof my time here meeting friends and realtives, its hard to resist taking a watch on the stock markets. Markets are continuing their northwards journey with little bits of pauses on where to go further. The energy looks unstoppable , however the road ahead is a bit steeper. Its very important to stick to fundamentals at this stgae and be choosy in stock selection.

Will get back with more flow to theblog once I am back to bangalore.

Cheers and Happy Investing !!

Read More!

Investment Idea : Narmada Chematur Petro.

CMP : Rs. 38

Target Price : Rs. 70

Period : 10 - 12Months

Risk : Moderate to Low

Investment Guru recommends investors to invest in Narmada Chematur Petrochemicals Limited with a year’s perspective. The company is all set to deliver excellent performance and the stock price should reflect the same.

What makes NCPL a good buy ?

Narmada Chematur Petrochemicals Limited (NCPL) is an Indo-Swedish Joint Venture Company of Gujarat Narmada Vally Fertilizers Company Limited (GNFC), Chematur Engineering AB, Sweden(CEAB), IBI Chematur, Mumbai (IBIC).

The company has made its mark in the field of Speciality Chemicals. The main products of the company are Aniline and TDI. The company enjoys near monopoly in the filed of TD, not only in India but also in South-east Asia.

Aniline, a specialty chemical has varied uses as a vital raw material in rubber chemicals, dyes & dye intermediates, MDI and pharmaceuticals. Hence the company’s product is a raw material for the Auto industry as well as textile industry, both of which are expected to do well in the coming years, hence good demand for NCPL’s products.

The presence of NCPL in the area of Aniline assumes greater importance, looking at the fact that the demand for Aniline is likely to increase at the rate of 8% per year

The company run on backward integration modeland sources its feedstock from GNFC(promoter company).

The company is currently operating at 140 % of its rated capacity and has expansion plans in place to leverage the growing demand for its products.

The company plans to get into manufacturing many value added products based on its core product, Aniline. NCPL is also starting a Product Application Development Centre to work towards finding newer avenues related to Polyurethane from and other future products.

The company boasts of excellent financials. The turnover has jumped 45% in FY05 as compared to earlier years. The net profit rose by 150%.

At current price of Rs.39 the company is traded at a P/E of 5 times its FY05 EPS. Given the prospects for good growth in the current year, the stock is expected to be an outperformer and give handsome returns to the shareholders.

Happy Investing !

(Disclosure: Investment Guru has a long term position in this stock. Please read the disclaimer clause before investing based on any recommendation on this blog)

Read More!

Market Watch : Never say die !

The rally looks stretched across the caps and sectors. The fireworks in the markets is expected to continue as the results seasons has not yet produced any major negatives. Monsoon is also on the right track. FII's continue their buying spree in the markets.

With this scenario in place, the obvious question that comes to a small investor is that Where is the Index moving ? Should I buy more at current levels or continue to hold? Shouls I start selling profitable stocks and start acumulating cash for buying at lower levels.

Keep a watch on the Investment Guru blog to answer all your questions. If you have any specific question on the Market trends , please leave a comment on this post.

Coming Soon on Investment Guru :

Stock Market : The Road Ahead

&

Investment Idea # 6

Read More!

IPO Update : IDFC Ltd.

IDFC is offering 40.36 crore shares through its initial public offer at a price band of Rs.29-34. Out of this 14.12 crore shares are offered to public.

Investment Guru recommends investors to apply in the IPO with a long term game plan. The stock is expected to bring smiles to investors in long term and reasonable listing gains also.

Let's look into the company

Management : The company is headed by Deepak Parekh who has taken HDFC to new heights. Under his able leadership and team full of stalwarts,the company should do well.

IDFC is an infrastructure play in business sense. The infrastructure sector is in limelight and is expected to be an outperformer in the long term. IDFC provides financing to Infrastructure companies.

With Infrastructure companies doing well, managing NPA's should not be an issue for the company. The company boasts of least NPA's among banks/financial institutions.

The company is focussing on the energy, trasportationtion ,telecommunications and oil and gas sectors to expand its financing.

IDFC's project finance assets (8000 crores) are as large as those of ICICI.

In the current year, company's share in the private infrastructure finance business is expected to be about 30%

IDFC Return on Assets (5.5%) is highest compared to any bank !!

The company has registered 18% increase in profits compared to last year (Profit after Tax Rs.304 Crores)

Senior debts forms the largest component in the financing portfolio and is an indicator of good quality of assets.

At offer price of Rs.34 at higher band, the stocks looks reasonably priced.

Read More!

The Third Eye - Gufic Bioscience

The stock has 52 Week high of Rs.46 and 52 week low of Rs.23

With market still maintaining at the top levels, investors are looking for stocks which have not yet run up high and that's why you will some some new stocks making news every other day. Read More!

Where is Investment Guru ?

You must be wondering why this blog is not updated for last 7 days? Where is Investment Guru? Is he away from the markets for time being ?

To reply to your questions I would say, partly yes and partly no.

I went for an offsite session on last friday, so didn't look at the markets.

I decided to do something different on this weekend, so just went out to a calm place to do some soul searching (no double meaning please !)

It's a good idea to go to a calm and peaceful place and just think about yourself and see whether you are living your life towards your objective or do you need to reorganise yourself.

I did a cursory watch on the markets during this week, which is not taking any breather as of now. I am right now more focused on selling in those stocks where I have good profits and have some liquidity to use when the markets takes a pause. I also believe that even if markets falls, some stocks are there to stay and go against the current. Just trying to identify those stocks (will share some of those with you , once I have some stuff to serve to you guys!)

I will be back with some more updates on the blog!

One more thing, if you have noticed that I have introduced one more link to the list of useful links . I would like to introduce you to the "FUN BLOG" It's a blog basically designed to provide some moments of laughter with good jokes. It is an open blog where you can share you jokes with all the viewers. Investment Guru recommends viewers to go through this blog regularly. Jokes play an important role in changing the mood swings to positive and bring smiles & laughing moments. I believe most of you will agree that to spend some such moments everyday is necessary. So lets join this effort to bring smiles to all faces and lets have some fun with the fun blog. Contribute jokes to the blog and be part of this blog. You can send your jokes to funfunda@sify.com

Cheers !

Read More!

The Third Eye : Teledata Informatics Ltd.

Teledata is showing good strength with high volumes. The stock is currently trading at Rs.28 (52 Week low is 22 and high is Rs.63)

The biggest weakness of the stock is that a large part of the holding is with general public. FII's and mutual funds had a good holding in the stock in Dec,2004. However they sold off majority of the holding by March.

However, in last few sessions, a buying momentum is seen and this a indicator of interest in the stock at current levels.

Investment Guru recommends investor to keep a watch on the counter . A few more sessions of good volumes can turn the tide for the stock. Moreover, the company has come out with good results.

Investors willing to take some risk can enter the counter right away.

( I am an active boarder at money control and I am aware that many investors were trapped in this stock at Rs. 60 levels. However,at current levels,the stock looks promising )

Happy Investing !!

Read More!

NectLife IPO Allotment Status

IPO Update: Vivimed Labs

Investment Guru recommends investors to apply for this IPO. The vivimed IPO is expected to deliver excellent listing gains due to various propositions. The company is offering 25 Lac shares of Rs.10 each at a premium of Rs.60.

What makes this IPO offer excellent listing gains?

Vivimed Lab has knocked the primary markets with an offer of 25 lac shares @Rs.70 per share.

The unique thing about this offer is that out of 25 Lac shares, the company is offering 18.5 Lac shares to public. This will lead to a rush for the stock by FII's and mutual funds on the listing. The stock is expected to give excellent listing gains.

The company is a leading manufacturer and exporter of API's. The company works in three segments viz., speciality chemicals, API's and generics.

The company is poised for a strong growth in its export earnings. The company expects growth in exports at 80%.

The clientele for this company includes leading companies in US and Euopean markets. In india, the company boasts of clients such as Hindustan lever, Marico & anchor.

The offer comes at a P/E of 6.92 , which is very attractive given valuations of this sector which trades at a P/E of more than 15.

Read More!

IPO Update: SRB Steels Limited

SRB Steels has come up with an IPO offering 2 Crore shares at a price band of Rs.20-22

Investment Guru Recommends investors to avoid this IPO.

Why shouldn't I apply in this IPO?

1. Considering the earnings of the company at Rs.2.99 per share, the offer comes at a P/E of 7.36 at the higher end of the price band. I would prefer to buy a quality steel stock like TISCO and JVSL that are trading at a P/E of 5.

2. The company is a part of Jai Balaji group of companies belonging to jajodia family. Looking at the waythe companiess are structured in the group, it doesn't look like a professionally managed group. Also, the other companies in the group are not doing well.

3. The Metal industry in general and steel sector in particular is going through a downward trend. The best approach is such cicumstances is to stick to quality stock.

Happy Investing !!

Read More!

IPO Update: Yash Papers Ltd.

Following are the points worth considering before applying to the public offer :

1.The stock is already listed on BSE and is currently quoting at Rs.20

2.The offer price comes at a P/E of 4. Let’s see how the stocks of its competitors doing in terms of P/E:

Star Paper : P/E 9

APPM: P/E 6

West coast: P/E 10

Shesasayee : P/E 5

3.The paper industry is expected to grow at a stong pace. The per capita consumption of paper in India is 5Kg per annum as compared to the Asian average of 27Kg per annum.

4.Yash papers is a market leader in the Kraft paper segment and has good presence even in Poster paper segment.

5.The Net Asset Value of the company's share post this issue will be Rs. 18.23

Inevstment Guru recommends Investors to apply for the IPO. However ,since the stock is already listed and we have visibility to the share price, investors should not expect extraordinary listing gains.

Issue Opens: 30-Jun-2005

Issue closes : 08-Jul-2005

Registrar: Skyline Financial Services Private Limited

Read More!

IPO Update : Provogue listing

The Provogue stock today listed on the NSE at Rs.249. The stock touched intra-day high of Rs.299 and is currently qouting at Rs. 270.

The listing is as per expectations and the stock has rewarded the few lucky shareholders who got allotment.

The strategy

Inevstment Guru recommends investors to book listing gains. They can re-enter the scrip later at lower levels in case they wish to hold for short to medium term.

Happy Investing!! Read More!

Investment Guru Rules.......

The debut Investment Idea by Investment Guru has shown its true colours !

Investment Guru recommended investment in Karnataka bank at Rs.64 levels in the month of May-05 for a period of three months and the stock is today ruling at Rs.119.

Felling left out ? Those viewers who have invested on Investment Guru's recommendation must be cheering up !!!

Those who have missed the chance are advised not to lose heart. Keep a close watch on this blog for the upcoming Investment Ideas!!!

Lots of Investment ideas to keep coming on this blog.

Happy Investing !!

Coming soon on Investment Guru

Watch Inevstment Guru taking stock of its recommendation and telling you how much you would have earned following the recommendations ! Investment Guru SCORE CARD coming soon....

Read More!

IPO Update : Beeyu Overseas

The Beeyu Overseas stock has listed yesterday on BSE . Though the stock touched a high of Rs.20 as compared to offer price of Rs.14, it could not sustain it and closed at Rs.16.

Investment Guru recommeds investors with long term mindset to hold to the stock. This stock will give a decent return in long run. Investment Guru puts a Rs.50 tag on this stock with 12-15 months perspective.

Happy Investing ! Read More!

Sector Watch: Media stocks

The Media stocks have seen a considerable interest after the news broke out that Anil Ambani has taken a majority stake in ADLABS. The stock caught fire with high volumes. Looks like every investor wants to Invest in whatever Anil ambani invests in !!

The other holdings on ambani group like birla corp, rallis India have also shown an upmove with higher volumes (though these are not media stocks)

The stock in action today were UTV and TV Today. TV today has hit the upper band with huge volumes of 65 lac shares traded and another 5 Lac in line with no sellers.

UTV bounced back with few weeks of lethargic show and moved up to Rs 180 before coling off to Rs. 172.

Investment Guru is of view that the fire in TV Today stock will continue even in tomorrow's session before traders start booking profits.

Next on Investment Guru ....

Will the market sustain the rally ?

Which are the stocks that are going to participate in the next round ?

Is the market slowly and steadily moving to the uncherised stocks ?

Get replies to these questions and many more on the upcoming article on Investment Guru blog.

Stay tuned to read more !

Read More!

The Third Eye : Polaris Software

The stock has shown an upcoming from the 98 levels and now is strongly placed at 125-130 range with strong volumes.

The Third Eye recommends a watch on the counter as it make higher moves. Those who have invested at 110-115 levels should keep a hold on the stock.

The stock looks good from a short to medium term prospective.

Happy Investing!! Read More!

IPO Update: Beeyu Overseas Allotment Status

The Allotment for Beeyu Overseas IPO has been done. Please check your deamt accounts to know how many shares you got alloted.

To chart your strategy for getting the maximum out of the listing, stay tuned to Investment Guru !

Happy Investing! Read More!

Provogue IPO: Check your Allotment Status

The Provogue IPO allotment is done and you can check the status of your applications .

Click here

The listing details will be updated on this blog soon!!

Happy Investing! Read More!

IPO Update:ERA Constructions

Era construction is offering 68 lac shares through a public issue at an offer price of Rs. 72 (fixed price) per share with a face value of Rs. 10.

Issue Opens : June 24,2005

Issue closes : June 29, 2005

Let’s Dig into the Company:

1. The company quotes that the issue proceeds will be used to acquire plant and machinery and augment the long-term working capital.

2. The shares of the company are already listed on BSE and is currently quoting at Rs.85 (lowest Rs. 66 during May2005)

3. Assuming a weighted average price of Rs. 80 till the allotment of shares is done, the issue gives a 10% return on the shares alloted.

4. The company earned an EPS of Rs. 8 per share (3 years weighted average EPS of Rs.6.5). This translates into a P/E of 10. However the P/E after the issue of shares will be 20, which looks expensive.

5. The company is a profit making company since its inception.

6. The company is dependant on few large orders rather than a large customer base.

7. Company has sizeable debtors as compared to its sales. It needs an agrresive strategy to improve its debtor’s turnover.

Though Investment Guru has a positive opinion on the construction sector, the valuations of ERA constructions look stretched.

Investment Guru recommends investors to stay away from this public offer. The stock is already listed and hence the valuations on listing of new shares will not be at par with the other IPO’s.

There are host of other IPO’s coming in the month of July and it is recommended to keep your money parked for those issues which will provide much better returns.

Stay tuned for an update on the forthcoming issues!

Happy Investing!

Read More!

Derivatives: Advanced Investment Strategy

Investment Guru introduce a new feature in the blog- Derivatives !

Welcome to the world of Derivatives. Derivatives , future and options to be more precise ,is the need of the hour. It is an effective tool for not only increasing your earning potential but also acts as an effective hedge for your positions in Cash markets and vice versa.

I have made a separate blog to deal with the Derivatives . The blog address is http://futurenoption.blogspot.com and carries the title "Derivatives".

So guys, be ready to learn about the derivatives tools and then I will discuss with you the strategies in derivatives market.

Gear up to be an Investor with an edge of derivatives.

Keep a watch on the Derivatives blog. I have provided a link to the blog on the right hand side bar for your convenience.

Happy Investing !

Read More!

IPO Update : Nectar Lifesciences Ltd.

Looking into the company :

Chandigarh-based Nectar Lifesciences Ltd. (NecLife) earlier known as Surya Medicare Ltd. is amongst the largest manufacturer and exporter of Cephalosporins and Semi Synthetic Penicillins in India.

The Cephalosporins drug segment is growing at a rapid pace and is the largest selling therapeutic segment in India. The company has aggresive plans to maintain its leadership position in this segment.

The company is also venturing into the Non-Antibiotic segment. The drugs to be produced under this segment belong to the category of Cardiovascular (CVS) / Anti-Histamine Therapeutic Segments. They are realtively new drugs and have huge growth potential.

The issue proceeds will be used to set up a new formulation plants at Baddi and derabassi & invest in Research and development activities.

The company has earned an EPS of Rs.20 for the year 2004-05 which converts into a P/E of 12 at the higher price band.

The company has sizeable debtors on its balance sheet which is around 25%of its sales.

Investment Guru recommends Investors to apply in the IPO. The valuations at the offer price looks reasonable in the current market scenario and leaves some scope for the listing gains. However, Investors should not keep their hopes too high with the listing gains. This is also an opportunity for those who wish to hold on for a long term to enter at the IPO levels.

Issue Opens : 22-June-2005

Issue Closes : 28-June-2005

Listing : BSE & NSE

Read More!

Market Update: Sky is the limit !

The market overtone still looks bullish with slight undertones of profit-booking expected at such levels. However, a landslide downfall is ruled out.

Where is the sensex headed now ?

With Index reaching uncharted territory, it is very difficult to predict the path ahead. However , if we take some clues from the indicators, the markets are expected to remain buoyant till FII's are posing their belief in the India story.

An intresting trend is that Mutual funds are booking profits at these level, which however, will not impact adversely since there are mutual fund offering coming in which will keep the buying spree intact.

Some regular bouts of profit booking is immitent at these levels , however, the markets are expected to keep intact the upward trend on an overall basis for some more time.

What is fuelling the markets ?

Again, the positive sentiments together with the end to the reliance dispute has helped the markets to go up. Reliance is expected to further fuel the markets. Market is expecting some big announcements from the elder brother now , after the younger brother Anil turned the markets sky rocketing with his press conference.

Another Factor is monsoons. FMCG sector is expected to come out of the blues and hence accumulated buying is seen in this sector.

Monsoons are also helping the Auto sector to keep its momentum.

Private banking stocks should continue to do well.

Steel prices are showing some rebounding, however the outlook is not still clear.

Capital goods and infrastructure stocks are expected to continue their rally.

What should small Investors do now ?

Are u feeling left out and want to participate now ?

Are u thinking what to do with your current holdings?

Investment Guru recommends Investors to be stock specific for any further buying in this market. Do not buy on rumors. Wait for the markets to settle down and be patient.

The best strategy in the coming days can be to give more weightage to IPO's than investing directly in markets at this stage. This will help you in getting maximum out of your money.

If any of your holdings has risen very sharply in this rally and their is no compelling reason for it to sustain it, Investor Guru recommend you to offload your holdings in such stocks, at least partly.

So stay tuned to markets and enjoy the ride to the new territory.

Happy Investing!

Read More!

Ganesh Forging : Mixed Trends

One reason for a luke warm listing may be the listing of the stock only on BSE which gives it lesser visibility and participation.

For Investors looking for listing gains, Investment Guru recommends to partly offload at a price of Rs. 50-52 and wait for another one or two days to see how it moves.

The short term outlook for this stock is weak.

Long term outlook for this stock is stable. So any Investor who wishes to hold it for period of 2 years can hold it for better gains.

Happy Investing!

Read More!

Ganesh Forgings: Get ready to Gain, Listing Today

Ganesh Forging's allotment of shares has been done. You can check your Demat accounts to know how much you got !

The share is going to list on BSE today!

The listing is expected to be excellent given the oversubscription and the market mood.

An update on how to deal with the listing gains will be provided later in the day today on Investment Guru.

So stay tuned!

Happy Investing! Read More!

Investment Idea -5 G E Shipping : Smooth sailing

Investment Guru recommends Investors to buy G E Shipping from a medium to long term perspective

CMP : 140.50

Target : Rs. 190 (3-4 Months)

What makes G E Shipping a good buy ?

1. G E Shipping is a high Dividend paying company. The company declared dividend of Rs. 9 last year. This stock is a great pick for Investor betting on dividend yield.

2. The company has earned a profit of Rs. 809 crores last year, which was 72% more as compared to previous year.

3. Total Revenues were up 48% at Rs.2119 Crores

4. The global oil demand is expected to rise by at least 2%. This will result in higher supply for oil and consequently higher business by shipping companies.

5. The tonnage rates are expected to see a marginal drop which will be compensated by the higher volumes.

6. The company has posted a robust EPS of Rs.43.81 per share as compared to Rs.22.63 last year.

7. At current levels the stock is trading at a P/E of just 3.2 which makes it a attractive investment at these levels.

8. Mutual funds are reported to be accumulating the stock at the current levels.

Happy Investing !

Read More!

IPO Update: Provogue IPO Oversubscribed ?

By now you must be hearing a lot about how much the Provogue IPO has oversubscribed .

You must be hearing somebody saying 19 times, other 20 times and some other forecasting it to even 40 times. So what's the real scenario and does the retail Investor need to be worried about his allotment prospects ?

Provogue IPO - Read the Fine Prints

The oversubscription talked about by people is generally confused by the Investors. It has nothing to do with their prospects for allotment. Actually your prospect for allotment depends on the oversubscription in your category. Most of us apply as individuals and under the retail category.

As per the latest indications the retail category is likely to be oversubscribed by 6-8 times.

The provogue IPO has seen huge subscription from the FII's, Mutual funds and Banks. These categories combined is likely to be oversubscribed by 25 times (indications)

So what does this means for the retail Investors ?

Is this good news or bad news ? Certainly it is good news for retail Investors if the FII and other categories get oversubscribed by a good number.

The reason being that these categories will not get sufficient allotment and will resort to buying from the markets. This will led to good listing of the IPO on the bourses.

So cheer up Investors and be lucky enough to get the allotment !

The word on the street is that the stock is going to list around 300 levels (I think I should stop here...ha ha ha !)

Read More!

Beware of Vanishing Companies

The issue of vanishing companies has again come to light with CNBC uncovering a story on the Soundcraft. It is very important for a Investor to check the company's credentials before buying into stocks , especially the small and little known companies. This is the only way to save yourself from their traps. The Department of company affairs has hosted a list of such vanishing companies on its website. Interestingly a big chunck of these companies are from Gujarat.

Please click the following link to view the list of companies and their details.

Vanishing Companies

Wish you safe Investing !

Cheers !

Read More!

Stock Update:Cybermedia hit Upper Circuit !!!

This a good news for the IPO Investors who are reaping good yield on thier Investment.

The stock has rung up on the news that Fidelity Investments has acquired a large chunck of Cybermedia shares. Fidelity Investments is respected worldwide for its longterm strategy.

Investment Guru recommends you to maintain a hold on this stock for medium term Investors.

For those who only want listing gains may sell this shares tomorrow before afternoon trade after which the stock may see some selling due to acumulated buying by traders.

Happy Investing !!

Read More!

IPO Update : Say “NO” to Yes Bank

Why should I stay away from this IPO ?

1. Yes bank is new to the banking business and does not have any brand value. The success of the bank depends on the brand value it is able to create which is uncertain at this stage for this bank.

2. Yes Bank has posted a Negative EPS for the first year of its operations. This means that the bank is a loss-making bank from sharholder’s perspective.

3. There are a number of good performing private sector banks in the market generating excellent profits. Why should one apply for a loss making bank IPO, that too at a premium of 350% over the face value?

4. The bank is expected to have a tough competition with the existing well-established private and poublic sector banks and the bank has not disclosed what innovative plans it has to compete with these banks.

Read More!

CYBER MEDIA lists with a bang !!!

Investment Guru recommends Investors to book profit on 50% of your holdings and keep another 50% to taste the upcoming days.

Happy Investing ! Read More!

IPO Update : Provogue (India) Ltd.

Provogue (India) Limited is offering 40.49 Lacs equity shares at a offer price band of Rs.130-150. Investment Guru recommends investors to apply for this IPO.It is recommended to book profits on listing of the share. The stock is expected to give handsome listing gains.

What makes this IPO offer attractive?

1. Considering the current EPS of the company at Rs.7, the offer comes at a P/E of 21. Now look at the comparison with the existing stocks in same industry :

Shopper Stop's stock is quoting at P/E of 45

Westside Stock is quoting at P/E of 47

pantaloon stock is quoting at P/E of 66

This itself is a sufficient reason to invest in IPO and an indication of handsome listing gains awaiting the Investors.

2. The apparels market has grown by 13% last year. Still, 70% of the market is captured by the unbranded apparel segment. The success of apparel companies depends on how fast can they convert this unbranded market to their advantage

3. The company has received number of awards for its brand value.

4. The cash flow position of the company is reasonably good.

5. Provogue come in Top 5 companies in terms of number of outlets giving it a wider reach as compared to peers.

6. New Quota Regime to benefit the apparel industry

7. Since the Apprael stocks have run up quite high,this sector has become a high risk sector and hence Investor are recommended to sell on listing. The stock is not recommended for long term hold at this stage.

Issue Details :

Issue Opens on : 10-June-2005

Issue Closes on : 16-June-2005

Listing on BSE & NSE

Shares Offered : 40.49 Lacs

Registrar: Intime Spectrum

Read More!

IPO Update : CYBER MEDIA Allotment

Those of you who have applied for Cyber Media IPO, The Allotments for the IPO has been done.

Please check your respective Demat accounts to check number of shares alloted to you.

The registrar for this issue was Intime Spectrum, but its website still do not show the allotment status for Cyber media. BSE/NSE has not yet issued the circular for listing detail.

Happy Investing !! Read More!

The Third Eye : Metal losing Sheen

Does it mean that that the metal sector has peaked out?

Since their respective peaks, metals like Aluminium and Zinc have fallen by more than 13%, Copper down by 8% . Nickel appears to be an exception?

One obvious reason is slowdown in Chinese economy, which is already facing a problem of overproduction.

Aluminium was trading at $1742 per tonne with 27 months futures trading at $1672 on the London metal Exchange on June 2.

Clearly, there is a sign of slowdown in prices of Metals and this is going to affect the bottomlines of the companies in this sector for the coming year.

The FII data shows that they were sellers in Metal stocks and moving to other growth stocks.

So, what does this means to the Investors?

Investment Guru is of view that Investors should avoid buying in the metal stocks at this stage as the metal stocks are bound to go southwards.

A wait and watch approach is recommended for at least a three month time period to assess the impact of slowdown on the share prices.

Which company will perform better?

Investment Guru believes that in the steel space, Investors should watch out for stocks like JVSL which was in news for approval to acquire Euro Coke and Energy Pvt. Ltd., Euro Ikon Iron and Steel Pvt. Ltd. and JSW Power Ltd. through a merger with the company.

This acquisition will bring in positive synergy for the company and will help it outperform other stocks in the steel space. The profit before Tax of the company will go up by Rs. 145 Crores due to this merger.

The combined entity will be available to the Investors at cheaper valuations as compared to other steel stocks.

But wait for the slowdown euphoria to die down so that you can enter the stock at attractive price.

Happy Investing!

Read More!

The Thrid Eye: Matrix Labs- The winning Combo

With this merger, Matrix will have access to new International markets.

Now the question is which company’s shareholder will benefit from this merger.

Investment Guru is of view that Matrix Lab shareholder should be the winner in this merger. Howver, the markets reacted otherwise in yesterday’s close when Strides Lab shares went up 13% while Matrix Lab shares went up only 2%. However, the final outcome will depend on the merger ration decided by the two companies.

Both the Shares are expected to show great action in this week’s trade, especially Thursday’s trade. Investment Guru Recommends a stratgey for Investors to gain handsomely form this merger. It is recommended to buy both Matrix and strides Lab shares in ratio of 3:1 i.e, for every two shares you buy for Matrix, buy one share of strides Lab also. This will hedge you in case of any surprise outcome of the merger ratio, which is yet to be decided.

Note : Please read the Disclaimer clause before acting on any recommendation on this blog

Read More!

Investment Idea- 4 Biocon –Unfolding Value

CMP : Rs. 417

Medium term target : Rs.500

Long term target : Rs.600-700 (depends on growth delivered by the company)

What holds the future for Biocon ?

Biocon generates 78% of its revenues for Bip-pharmaceuticals and only 9% from research services. However, the company is looking at Research services to be the Key growth drivers of its future earnings together with its leadership in the Insulin segment.

Performance

The company has delivered good results . The sales have crossed Rs. 700 crores . The profit after tax has increased by 49%. The company has also declared 40% dividend.

The company has entered into strategic alliance with Vaccinex.Inc USA,to discover and co-develop therapeutic antibody products. This partnership is expected to open up a Multi Billion dollar opportunity for Biocon.

The EPS for FY04-05 was Rs. 20 which converts into P/E of 21 for the current market price.

Promoter hold 65% stake in the company.

About Biocon

Biocon is India's leading biotechnology enterprise. It is ranked No. 1 Biotech company in India and No.16 in the world It is the largest and only USFDA approved producer and exporters of STATINS. The company boasts of Asia largest Insulin plant located in Bangalore. Biocon R&D has key focus areas of Diabetes and oncolgy which could result to be a major revenue generator in coming years. India has 31 Million diabetic cases in year 2000 and this number is expected to go to 79 million by year 2030.

Biocon has alliance with CIMAB to work for clinical research for neck and head cancer.

Key products

Human Insulin, Oral Anti diabetic, statins, tacrolimus, sirolimus

Read More!

The Third Eye : ITC Ltd.

Happy Investing!! Read More!

IPO update: Beeyu Overseas

IPO Details

The company has come up with an IPO and is offering 71 lakh shares to public at Rs. 14 per share.

Beeyu Overseas is 100% export oriented company. It exports Tea and coffee and has Estates in Ooty and exports to number of countries including UK, UAE and CIS which account for a major share of the exports. The company has aggressive growth plans in place to increase its export earnings.

The issue is priced at a P/E of 11, which looks reasonable in view of the performance of existing Tea stocks, which have an average P/E of 19.

The current Book Value of the companyÂ’s share is Rs. 17.34

Read More!

The Third Eye : Moser Baer

This stock is a darling of the Swing Traders and why not, the bandwidth that this stock provides speaks for itself.

The stock has an intact swing between the range of Rs.205 - Rs. 240. These are the two strong pillars between which the stock price swings quite frequently. The stock is not able to break any of this range.

Good stock for day traders. The third eye recommends keeping an eye on the counter as the stock moves in this range and tries to break it out. Safe to enter between Rs.205-210 range and exit between Rs.230-240 range for swing trading.

Happy Investing!! Read More!

Health Watch: Coping with Stress

Coping with stress?

1. Recognise the fact that stress is a part of life and your body will automatically prepare itself to manage it better. Don’t panic.

2. Believe in yourself: Most of the times we are stressed not because of a thing, but due to the perception we build in about the thing. Change your perceptions. Remember that you are more powerful and channelise your positive energy to fight stress.

3. Anticipate Stress: Many times the stress is caused by repeititive reasons. Analyse the reasons causing the stress and manage yourself in order to avoid that situation.

4. Think positive: Do your best in whatever you do and the results will certainly be motivating.

5. Express yourself. Talk about your problems. Suppressed feelings, anxieties, self-doubts, and low esteem are among major stresses that lead to illness and disease.

Read More!

Investment Idea -3 Skumars Nationwide Ltd.

Skumar Nationwide stock is recommended for a long term Investment (1 -2 Years)

Current Market Price : Rs. 23

The target price

With its entire expansion and growth plan in place, the company is expected to achieve a targeted FY06 EPS of Rs.4 and FY07 EPS of Rs. 6. With the textile sector in limelight and expected to garner higher valuations, the stock can touch the Rs. 40-50 levels within one year on a conservative basis and Rs.70-80 levels in next two years.

(Please read the disclaimer clause before acting on any recommendations or ideas on this blog)

What makes this stock a good buy?

Skumar nationwide is a turnaround story in making and belongs to the textile sector, which is expected to emerge as an outperformer in the long term.

Skumars boast of brands like Reid & Taylor and Tamarind.

The company has pruned its bottom line with a debt restructuring exercise to take heads-on the vast growth opportunities in its niche areas. The company’s strategy includes operating in all segments of the textile sector.The company has plan to alliance with International brands and make further inroads in the retail business.It also plans to invest Rs. 300 crore over the next five years to give shape to its plans and the money could be raised through privtae placement. The private placement will also help unlock the value for the shareholders

Read More!

IPO Update: SHREE GANESH FORGINGS

At the Offer Price Rs.30 and the EPS of Rs. 5, the offer comes at a P/E of 6.

Considering the current market scenario, the stock is worth considering for applying in the IPO to garner the LISTING gains. However, long term hold in this stock is not advisable. Book your profits within a week of the listing to be on safer side.

Company Info

The company had a total current installed capacity of 15,000 MT per annum. The Company has gone for a major expansion programme and has added 20 ton Counter Blow Hammer and Open Forging facilities which will substantially increase the current installed capacity to nearly 30,000 MT per annum

SGF baosts of customers in the Automotive Industry, Two Wheeler Industry, Earth Moving Industry, Tractor Industry and for Defense application.

The compnay has been incerasing its export pie. It has export customers in USA, Canada, U.K., Ireland, Europe and Middle East markets

Read More!

Welcome Google !

Google has entered the Investment Guru Blog. Thanks to Google for choosing this blog for Google ads and search engine !

Now you can view relevant ads by Google and can also use Google search engine from this blog.

The Search engine and ads are located on the side bar.

Thanks for your patronage to this blog !

Cheers!! Read More!

Diversifying your Investments

1. Identify various areas for Investments. For example Equity shares, Debentures, Govt. securities, Bonds, Mutual funds, fixed deposits, Insurance products etc.