PARSVNATH DEVELOPERS IPO AllOTMENT STATUS

Finally it's out! You can check if you got the shares alloted from the link below

CLICK HERE TO CHECK ALLOTMENT STATUS !

Read More!

PARSVNATH IPO AllOTMENT STATUS

Posted by

Rajesh Soni

Saturday, November 25, 2006

Labels:

IPO Updates,

Parsvnath Developers

9

comments

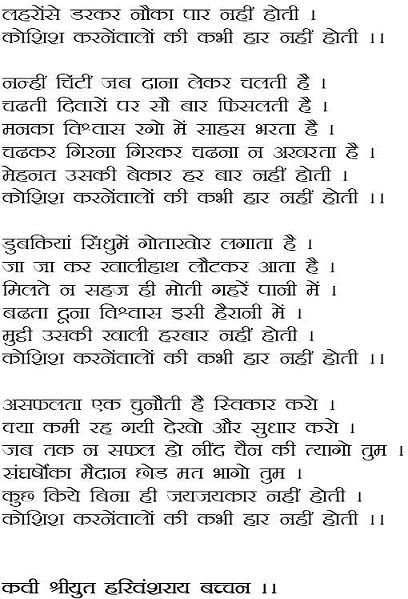

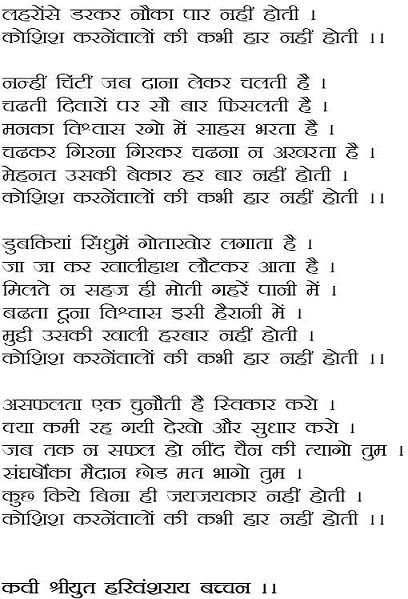

An Inspirational Poem

This is a inspirational poem by great Indian Poet Shri Harivansh Rai Bachhan. I thought of sharing it with all of you. So if you are feeling left out or demotivated, just read this poem and boost your innerself with confidence. The motto is that Try and try and you will get success. Same applies even to stock markets, where we learn from our mistakes in order to become a smart Investor !

Stock in News : Dabur, L&T, Videocon

Posted by

Rajesh Soni

Thursday, November 23, 2006

Labels:

Dabur,

Larsen Toubro,

Reliance Industries,

Stocks in News

2

comments

Reliance ties up with Dabur for retail venture

Reliance has entered into a one-year pact with Dabur, under which it would sell Ayurvedic products such as chawanprash, and personal care items like hair oil through its retail outlets. Under this agreement, Dabur would generate about Rs 90 crore in revenues annually.

Larsen & Toubro plans new shipyard in India

Larsen & Toubro Ltd plans to set up large shipyard at a cost of about 20 billion rupees to capitalise on expected demand for vessels as international trade grows. The company already

builds ships at Hazira in Gujarat, but Naik this facility could only handle smaller vessels.

RIL set to bag 7 prized oil blocks

In what could result in Reliance Industries Ltd’s virtual dominance of the deep-water Krishna Godavari and Mahanadi basins off the east coast of India, the Directorate General of Hydrocarbons (DGH) has recommended that the company be granted seven highly prized assets in the region to prospect for oil and gas.

Videocon buys shares in Cairn Energy

New York-based investment firm Blackrock-Merrill Lynch and Indian electronics major Videocon Industries (VIL) are believed to have bought shares worth close to $100m in the pre-IPO placement of Cairn India, a subsidiary of the Edinburgh-based Cairn Energy. Both investors are tipped to have bagged shares worth $50m each.

Gateway to buy 50.1% stake in Snowman

Gateway will subscribe to 34.39 million new equity shares of Snowman at Rs 10.50 a share. Snowman provides GDL with a well-established platform to explore the tremendous growth opportunities in the booming cold chain logistics business.

Siemens gets Rs 40 bn order

Siemens Ltd said on Wednesday it has bagged a contract worth 40 billion rupees in the power transmission and distribution segment.

PNB ties up with IDBI Capital

Punjab National Bank (PNB) on Wednesday tied up with IDBI Capital to provide advanced e-trading services to its customers.

Bulk Deal Updates

Fidelity Buys 11 Lac Shares of Info Edge at 587 per share

Citi Group Buys 15 Lac Shares of Spice Jet. Read More!

Reliance has entered into a one-year pact with Dabur, under which it would sell Ayurvedic products such as chawanprash, and personal care items like hair oil through its retail outlets. Under this agreement, Dabur would generate about Rs 90 crore in revenues annually.

Larsen & Toubro plans new shipyard in India

Larsen & Toubro Ltd plans to set up large shipyard at a cost of about 20 billion rupees to capitalise on expected demand for vessels as international trade grows. The company already

builds ships at Hazira in Gujarat, but Naik this facility could only handle smaller vessels.

RIL set to bag 7 prized oil blocks

In what could result in Reliance Industries Ltd’s virtual dominance of the deep-water Krishna Godavari and Mahanadi basins off the east coast of India, the Directorate General of Hydrocarbons (DGH) has recommended that the company be granted seven highly prized assets in the region to prospect for oil and gas.

Videocon buys shares in Cairn Energy

New York-based investment firm Blackrock-Merrill Lynch and Indian electronics major Videocon Industries (VIL) are believed to have bought shares worth close to $100m in the pre-IPO placement of Cairn India, a subsidiary of the Edinburgh-based Cairn Energy. Both investors are tipped to have bagged shares worth $50m each.

Gateway to buy 50.1% stake in Snowman

Gateway will subscribe to 34.39 million new equity shares of Snowman at Rs 10.50 a share. Snowman provides GDL with a well-established platform to explore the tremendous growth opportunities in the booming cold chain logistics business.

Siemens gets Rs 40 bn order

Siemens Ltd said on Wednesday it has bagged a contract worth 40 billion rupees in the power transmission and distribution segment.

PNB ties up with IDBI Capital

Punjab National Bank (PNB) on Wednesday tied up with IDBI Capital to provide advanced e-trading services to its customers.

Bulk Deal Updates

Fidelity Buys 11 Lac Shares of Info Edge at 587 per share

Citi Group Buys 15 Lac Shares of Spice Jet. Read More!

Bursa at a life time high!

Confused with the heading of this post ? Wondering , what crib I am talking about. Is this a new stock or what ? Never heard!

Confused with the heading of this post ? Wondering , what crib I am talking about. Is this a new stock or what ? Never heard!Well Guys, I am not talking about any stock , but I am talking about the Malaysian Stock Market. I was in Malaysia (KL to be precise) for last 4 days on a fun-filled visit. Though the fun was so hectic that I could not look at Indian markets, but couldn't resist my temptation to know something about the Malaysian stock markets. and guess what! Malaysian stocks are also at their life-time highs. The going is pretty good for the malaysian stocks . Genting, UMW, Lingui and BAT are few of the stocks that are rocking the malaysian markets.

The visit to Petronas Towers (the tallest building in the world) was unforgettable. Petronas is the Oil and Petroleum giant of Malaysia and is owned by the government. Also did some shopping at the Suria Mall and the China town. The dance party at KL towers was an amazing experience when you come out and realise that you were partying at such heights.

So overall a fun filled journey, thanks to my organisation. Will get back to the Indian stock markets in the coming post. Read More!

Stocks in News: Inox, TCS, Dabur

Posted by

Rajesh Soni

Monday, November 13, 2006

Labels:

Dabur,

ONGC,

Reliance Industries,

Stocks in News,

TCS

2

comments

TCS wins $35 mn Eli Lilly contract

Indian software major Tata Consultancy Services (TCS) has landed a large pharma BPO contract from Eli Lilly to provide drug development services, including clinical trial data management, statistical analysis and medical writing, to the global pharma major. Industry sources estimate that the multi-year contract is in the range of $30-35m. Read More

RIL cuts retail fuel prices

Reliance Industries, whose fuel retail business took a hit after it hiked rates early this year, has reduced the sale price of petrol and diesel by Rs 2.50 per litre to bring it on par with prices of petro products sold by public sector undertakings. Read More

ONGC drops JV plan with Hindujas

State-owned Oil and Natural Gas Corporation (ONGC) has walked out of a proposed JV with the Hindujas at the last minute even though the oil major’s board had approved the deal on October 19. Read More

Dabur eyes stake in Australian winery

Amit Burman of Dabur is headed Down Under to give shape to his fledgling wine interests. Mr Burman, who has floated Nature’s Bounty Wines & Allied Products outside the Dabur Group, is expected to acquire a strategic stake in the privately-held Toorak Wineries, located in the New South Wales region of Australia. Read More

Reliance, BSNL in strategic tie-up

Over 80m subscribers of BSNL and Reliance will now be able to access 1-800 numbers provided by either operator, thus, paving the way for network-independent access to 1-800 services in India for the first time. An agreement to this effect has been reached between Reliance Communications (RCL) and BSNL. Read More Read More!

Indian software major Tata Consultancy Services (TCS) has landed a large pharma BPO contract from Eli Lilly to provide drug development services, including clinical trial data management, statistical analysis and medical writing, to the global pharma major. Industry sources estimate that the multi-year contract is in the range of $30-35m. Read More

RIL cuts retail fuel prices

Reliance Industries, whose fuel retail business took a hit after it hiked rates early this year, has reduced the sale price of petrol and diesel by Rs 2.50 per litre to bring it on par with prices of petro products sold by public sector undertakings. Read More

ONGC drops JV plan with Hindujas

State-owned Oil and Natural Gas Corporation (ONGC) has walked out of a proposed JV with the Hindujas at the last minute even though the oil major’s board had approved the deal on October 19. Read More

Dabur eyes stake in Australian winery

Amit Burman of Dabur is headed Down Under to give shape to his fledgling wine interests. Mr Burman, who has floated Nature’s Bounty Wines & Allied Products outside the Dabur Group, is expected to acquire a strategic stake in the privately-held Toorak Wineries, located in the New South Wales region of Australia. Read More

Reliance, BSNL in strategic tie-up

Over 80m subscribers of BSNL and Reliance will now be able to access 1-800 numbers provided by either operator, thus, paving the way for network-independent access to 1-800 services in India for the first time. An agreement to this effect has been reached between Reliance Communications (RCL) and BSNL. Read More Read More!

Market Mood : All time high, What’s next ?

The carnival to continue on bumpy roads

The mood are bullish and the traders must be partying this weekend with the sensex rising to its all time highs amid bouts of volatility in the last week. The sensex closed at 13295 adding the valuable 165 points to its tally during the week. When I say valuable, it has a meaning, its not just an adjective to decorate my post. This addition to sensex has a lot to do to demonstrate that the energy levels in the markets are still high and we have a way to go before reaching the crossroads. This rally has also underlined the strength of the India Inc. which was visible the Q2 earnings show.

The mood are bullish and the traders must be partying this weekend with the sensex rising to its all time highs amid bouts of volatility in the last week. The sensex closed at 13295 adding the valuable 165 points to its tally during the week. When I say valuable, it has a meaning, its not just an adjective to decorate my post. This addition to sensex has a lot to do to demonstrate that the energy levels in the markets are still high and we have a way to go before reaching the crossroads. This rally has also underlined the strength of the India Inc. which was visible the Q2 earnings show.

Let’s look at some of the factors that may provide insight into the way markets are likely to drive in the coming days.

Q2 results were sizzling !

Yes, it was a pretty impressive show put up by the India Inc. Indian companies saw robust growth both in terms of the topline (Sales) and bottomline (Profit) with positive guidance on the coming quarters. The bright thing in the whoile story was that a good chunk of Mid companies have also reported a terrific growth and have helped to lift the overall sentiments for the markets . This is in contrast to the rally seen in the month of July and august which was primarily driven by large caps.

Read out few success stories of India inc.. in Q2 in the print Media. DNA reports that the GDP and industrial production growth figures had broadly confirmed that the economy continues to grow at a healthy pace

Financial express reports that India Inc demonstrated superior performance, that too in the toughest quarter of the year. Most industries usually saw a cyclical slackness due to the monsoons and a general slowdown in the second quarter. An aggregate of 435 companies, whose results were analysed by FE, showed that these companies posted a 32.4% rise in net profit over the same period last year. Sales grew to Rs 1,66,295 crore during the quarter ended September 2006. This represented a 31.4% over the same quarter in the previous year.

Economic times in its story “India Inc. bottomline hits the roof” reports that its analysis shows that India Inc is improving its margin through cost rationalisation and better pricing. This is unlike last year, when lower interest costs and tax rates had to compensate for the fall in operating margins for maintaining the PAT margin.

The Q2 results have been able to revive the investor confidence in the recent rally and has led big players to revise their targets for the Indian companies, which eventually lead the way for sensex to put up a bold face.

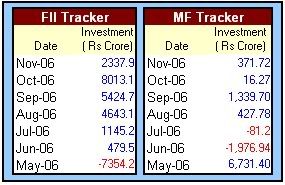

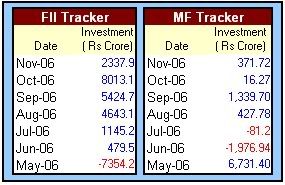

FII’s continue to buy India story

FII’s continued to be net buyers in the month of November. They have bought around 2338 crores till now in November. See the Chart below for Net Investment pattern of FII since after the May debacle and the story would speak for itself.

Mid Cap stocks get re-rating

The Q2 results also brought a respite to the mid cap stocks that were laggards in the earlier phase of the pullback. Select Midcap stocks which had delivered strong results were stocked by the investors. The trend is expected to continue as these stories unveil and as these companies roll their future plans.

The Road Ahead

Look at the graph above and you can experience the pleasant ride from the lows of May to the highs of November. The technicals are placed in positive zones and are not sending any negative signals.

Investors may expect the markets to continue its ride toward the new horizons. However, we may see more volatility in the coming days as some investor groups may tend to book profits on every rise rather than leaving everything on the table. The broader market sentiments are positive and 13500 on sensex would be the next level to watch and we are just 205 points way from there!

Happy Investing ! Read More!

The mood are bullish and the traders must be partying this weekend with the sensex rising to its all time highs amid bouts of volatility in the last week. The sensex closed at 13295 adding the valuable 165 points to its tally during the week. When I say valuable, it has a meaning, its not just an adjective to decorate my post. This addition to sensex has a lot to do to demonstrate that the energy levels in the markets are still high and we have a way to go before reaching the crossroads. This rally has also underlined the strength of the India Inc. which was visible the Q2 earnings show.

The mood are bullish and the traders must be partying this weekend with the sensex rising to its all time highs amid bouts of volatility in the last week. The sensex closed at 13295 adding the valuable 165 points to its tally during the week. When I say valuable, it has a meaning, its not just an adjective to decorate my post. This addition to sensex has a lot to do to demonstrate that the energy levels in the markets are still high and we have a way to go before reaching the crossroads. This rally has also underlined the strength of the India Inc. which was visible the Q2 earnings show.Let’s look at some of the factors that may provide insight into the way markets are likely to drive in the coming days.

Q2 results were sizzling !

Yes, it was a pretty impressive show put up by the India Inc. Indian companies saw robust growth both in terms of the topline (Sales) and bottomline (Profit) with positive guidance on the coming quarters. The bright thing in the whoile story was that a good chunk of Mid companies have also reported a terrific growth and have helped to lift the overall sentiments for the markets . This is in contrast to the rally seen in the month of July and august which was primarily driven by large caps.

Read out few success stories of India inc.. in Q2 in the print Media. DNA reports that the GDP and industrial production growth figures had broadly confirmed that the economy continues to grow at a healthy pace

Financial express reports that India Inc demonstrated superior performance, that too in the toughest quarter of the year. Most industries usually saw a cyclical slackness due to the monsoons and a general slowdown in the second quarter. An aggregate of 435 companies, whose results were analysed by FE, showed that these companies posted a 32.4% rise in net profit over the same period last year. Sales grew to Rs 1,66,295 crore during the quarter ended September 2006. This represented a 31.4% over the same quarter in the previous year.

Economic times in its story “India Inc. bottomline hits the roof” reports that its analysis shows that India Inc is improving its margin through cost rationalisation and better pricing. This is unlike last year, when lower interest costs and tax rates had to compensate for the fall in operating margins for maintaining the PAT margin.

The Q2 results have been able to revive the investor confidence in the recent rally and has led big players to revise their targets for the Indian companies, which eventually lead the way for sensex to put up a bold face.

FII’s continue to buy India story

FII’s continued to be net buyers in the month of November. They have bought around 2338 crores till now in November. See the Chart below for Net Investment pattern of FII since after the May debacle and the story would speak for itself.

Mid Cap stocks get re-rating

The Q2 results also brought a respite to the mid cap stocks that were laggards in the earlier phase of the pullback. Select Midcap stocks which had delivered strong results were stocked by the investors. The trend is expected to continue as these stories unveil and as these companies roll their future plans.

The Road Ahead

Look at the graph above and you can experience the pleasant ride from the lows of May to the highs of November. The technicals are placed in positive zones and are not sending any negative signals.

Investors may expect the markets to continue its ride toward the new horizons. However, we may see more volatility in the coming days as some investor groups may tend to book profits on every rise rather than leaving everything on the table. The broader market sentiments are positive and 13500 on sensex would be the next level to watch and we are just 205 points way from there!

Happy Investing ! Read More!

IPO Update: Parsvnath Developers Ltd.

Posted by

Rajesh Soni

Thursday, November 09, 2006

Labels:

IPO Updates,

Parsvnath Developers

8

comments

Riding on Construction Boom

Parsvnath developers has entered the capital markets with a public offer of 3.32 crore equity shares at a price band of Rs. 250-300. Investment Guru recommends investors to subscribe to the issue. The issue is expected to garner moderate listing gains and could also be considered for a medium term hold.

Highlights of the issue

Parsvnath is one of the leading real estate development companies in India with operations in 41 cities and 14 states of India. The company directly owns or helds development rights for an estimated 108.64 million square feet of saleable area.

The company intends to develop 20 integrated townships, 27 commercial complexes including shopping malls, multiplexes, office space and a complete metro station and 25 residential projects. It also intend to construct 14 hotels and four information technology parks on commercial land acquired by us or in respect of which it has development rights.

Financials : Company's Revenue from operations stood at 643 crores for the FY06, an increase of 212% over previous year. Net profits have shown a increase of 163%. For the quarter ended June '06, the company has acheived a topline growth of 167 % over same quarter last year. Net profits increased by 226 % during the above period.

Positives :The company mentions its ability to identify emerging markets and assess the potential of a location, marketing network, diversified business model, timely and cost efficient completion of projects and transparent and efficient system of procuring materials as its qualitative strenghts.

Valuations :The weighted average EPS for last three years comes to Rs. 5.29. The EPS for the first quarter of this year comes to 2.46. If we take the etimated FY07 EPS of Rs. 9 for the company, the issue comes at a PE of 28 at the lower price band and at 33 times on the upper price band.

If we compare the offer price with the valuation of exitng listed players the valuations appear to be in the middle path and looks reasonable since the company is diversifying itself from a residential play to a commercial space player.

Return on Net worth is 53% which looks good as other competitors except DS Kulkarni are generating lower returns.

Risk Factors : The construction space as a whole commands a high PE in the stock markets given the huge potential and focus on housing and infrastructural development in the country. However, any negative developments or barriers on this front may lead to rerating of this sector. Apart from this Parsvnath is also battling the ownership of its brand name. The verdict if against the company may impact it adversely. Another concern is the negative cash flows in the last two financial year as well as the last quarter.

Issue Opens : November 06, 2006

Issue Closes :November 10, 2006

Registrar : Intime Spectrum

Additional references

Parsvnath developers Website

Company's Vision

Key Personnel

Prospectus Read More!

Parsvnath developers has entered the capital markets with a public offer of 3.32 crore equity shares at a price band of Rs. 250-300. Investment Guru recommends investors to subscribe to the issue. The issue is expected to garner moderate listing gains and could also be considered for a medium term hold.

Highlights of the issue

Parsvnath is one of the leading real estate development companies in India with operations in 41 cities and 14 states of India. The company directly owns or helds development rights for an estimated 108.64 million square feet of saleable area.

The company intends to develop 20 integrated townships, 27 commercial complexes including shopping malls, multiplexes, office space and a complete metro station and 25 residential projects. It also intend to construct 14 hotels and four information technology parks on commercial land acquired by us or in respect of which it has development rights.

Financials : Company's Revenue from operations stood at 643 crores for the FY06, an increase of 212% over previous year. Net profits have shown a increase of 163%. For the quarter ended June '06, the company has acheived a topline growth of 167 % over same quarter last year. Net profits increased by 226 % during the above period.

Positives :The company mentions its ability to identify emerging markets and assess the potential of a location, marketing network, diversified business model, timely and cost efficient completion of projects and transparent and efficient system of procuring materials as its qualitative strenghts.

Valuations :The weighted average EPS for last three years comes to Rs. 5.29. The EPS for the first quarter of this year comes to 2.46. If we take the etimated FY07 EPS of Rs. 9 for the company, the issue comes at a PE of 28 at the lower price band and at 33 times on the upper price band.

If we compare the offer price with the valuation of exitng listed players the valuations appear to be in the middle path and looks reasonable since the company is diversifying itself from a residential play to a commercial space player.

Return on Net worth is 53% which looks good as other competitors except DS Kulkarni are generating lower returns.

Risk Factors : The construction space as a whole commands a high PE in the stock markets given the huge potential and focus on housing and infrastructural development in the country. However, any negative developments or barriers on this front may lead to rerating of this sector. Apart from this Parsvnath is also battling the ownership of its brand name. The verdict if against the company may impact it adversely. Another concern is the negative cash flows in the last two financial year as well as the last quarter.

Issue Opens : November 06, 2006

Issue Closes :November 10, 2006

Registrar : Intime Spectrum

Additional references

Parsvnath developers Website

Company's Vision

Key Personnel

Prospectus Read More!

Stocks in News : Reliance, SAIL, TATA, ONGC

Reliance looks for rapid retail expansion

By 2010/11 we will be in 784 cities and towns in urban India, and in 6,000-plus rural locations," Raghu Pillai, president of Reliance Retail Ltd, said in an interview at the opening of a store in the southern city of Hyderabad, the capital of Andhra Pradesh. Cash-rich Reliance Industries, India's top petrochemical maker, is investing around $5.6 billion in setting up a nationwide retail chain of hypermarkets, supermarkets, discount stores, department stores, convenience and specialty stores. Read More

Also read Reliance eyes pan-India retail footprint in 5 years

SAIL's corporate plan could shoot up by Rs 8,000 cr

SAIL's Corporate Plan envisages expenditure worth Rs 37,000 crore, which is likely to shoot up to Rs 45,000 crore. The Plan envisages upgradation of all steel plants of the steel giant to meet India's growing demand for steel. Read More

Tata Tea plans green revolution for Tetley, Gold

Tata Tea has firmed up a slew of packet tea launches under its Tetley and Tata Tea brands to maintain 10% growth in its branded tea business in ’06-07. For starters, it will launch green tea under the Tetley banner and premium Darjeeling under the Tata Gold brand. Read More

UB Grp arm, Russian vodka maker ink deal

Through this alliance, the United Spirits will introduce Russian vodka brands manufactured and supplied by Russian Standard in India. While the Russian company, which has a broad distribution network in Russia and other CIS markets, will market the premium whiskey brands of United Spirits in Russia Read More

Hindustan Dorr-Oliver gains on new order win

Hindustan Dorr-Oliver (HDO) rose 3.62% to Rs 123, after reports that it along with China Aluminium International Engineering Corporation has jointly bagged an order from Vedanta Alumina for Rs 200 crore. Read More

ONGC may rope in Hindujas for oil hunt

After tying up with steel tycoon Lakshmi N Mittal, Oil and Natural Gas Corporation (ONGC) is roping in the diversified, multi-billion dollar Hinduja group for acquiring oilfields abroad and sourcing liquefied natural gas. Read More

Info Edge IPO sold 50 times

The initial public offer (IPO) of Info Edge India Ltd, the first Indian dotcom to go public on domestic bourses, received an overwhelming response from investors with the IPO getting oversubscribed by more than 50 times. Read More

Reliance Capital to acquire Travelmate Services

The acquisition would mark its foray into the fast growing forex changing and money transfer business. Travelmate is a unit of the Kuoni Group with 36 offices, 2,900 agents and 91 employees across the country. Read More Read More!

By 2010/11 we will be in 784 cities and towns in urban India, and in 6,000-plus rural locations," Raghu Pillai, president of Reliance Retail Ltd, said in an interview at the opening of a store in the southern city of Hyderabad, the capital of Andhra Pradesh. Cash-rich Reliance Industries, India's top petrochemical maker, is investing around $5.6 billion in setting up a nationwide retail chain of hypermarkets, supermarkets, discount stores, department stores, convenience and specialty stores. Read More

Also read Reliance eyes pan-India retail footprint in 5 years

SAIL's corporate plan could shoot up by Rs 8,000 cr

SAIL's Corporate Plan envisages expenditure worth Rs 37,000 crore, which is likely to shoot up to Rs 45,000 crore. The Plan envisages upgradation of all steel plants of the steel giant to meet India's growing demand for steel. Read More

Tata Tea plans green revolution for Tetley, Gold

Tata Tea has firmed up a slew of packet tea launches under its Tetley and Tata Tea brands to maintain 10% growth in its branded tea business in ’06-07. For starters, it will launch green tea under the Tetley banner and premium Darjeeling under the Tata Gold brand. Read More

UB Grp arm, Russian vodka maker ink deal

Through this alliance, the United Spirits will introduce Russian vodka brands manufactured and supplied by Russian Standard in India. While the Russian company, which has a broad distribution network in Russia and other CIS markets, will market the premium whiskey brands of United Spirits in Russia Read More

Hindustan Dorr-Oliver gains on new order win

Hindustan Dorr-Oliver (HDO) rose 3.62% to Rs 123, after reports that it along with China Aluminium International Engineering Corporation has jointly bagged an order from Vedanta Alumina for Rs 200 crore. Read More

ONGC may rope in Hindujas for oil hunt

After tying up with steel tycoon Lakshmi N Mittal, Oil and Natural Gas Corporation (ONGC) is roping in the diversified, multi-billion dollar Hinduja group for acquiring oilfields abroad and sourcing liquefied natural gas. Read More

Info Edge IPO sold 50 times

The initial public offer (IPO) of Info Edge India Ltd, the first Indian dotcom to go public on domestic bourses, received an overwhelming response from investors with the IPO getting oversubscribed by more than 50 times. Read More

Reliance Capital to acquire Travelmate Services

The acquisition would mark its foray into the fast growing forex changing and money transfer business. Travelmate is a unit of the Kuoni Group with 36 offices, 2,900 agents and 91 employees across the country. Read More Read More!

Opening Bell - Markets to Consolidate

The markets are expected to consolidate the gains build up in its journey in last few sessions. The sentiments looks positive. FII's are busy buying stocks with net buying of 368 Crore on Wednesday. Mutuals funds have also woken up and have fuelled up their buying. They were net buyers of Rs. 311 crores. On the Global indices, Asian markets have thrown a mixed response while the US markets were down. However, at present the Indian markets are driven more by local factors than the global trends.

The markets are expected to consolidate the gains build up in its journey in last few sessions. The sentiments looks positive. FII's are busy buying stocks with net buying of 368 Crore on Wednesday. Mutuals funds have also woken up and have fuelled up their buying. They were net buyers of Rs. 311 crores. On the Global indices, Asian markets have thrown a mixed response while the US markets were down. However, at present the Indian markets are driven more by local factors than the global trends.Talking of stocks, Reliance Indutries felt just 1 rupee short of the 1300 mark. The company has opened a slew of Reliance fresh stores today in Hyderabad. The stock is expected to cross the 1300 mark and close above that level in today's session.

Other stocks to watch are GVK Power, Era Construction, ICSA and Gitanjali Gems.

Read More!