Though the scheme is launched for various urban areas, the center of attraction is the allotment of 1,969 plots of various sizes in Faridabad.

Salient Features of the Scheme

- Faridabad is an integral part of the NCR region and has good connectivity and proximity to Delhi. Though the region has been sluggish as compared to other NCR regions like Gurgaon is terms of appreciation in real estate prices, it does offer ample scope as there are talks of modernization of Mathura Road and work on Badarpur flyover as well as access to Metro in near future will provide facelift to the area.

- Crime Rate in Faridabad is far less as compared to other popular regions in terms of real estate development like Noida and Ghaziabad.

- The Rates offered in HUDA Scheme are quite competitive and offer even a good long term investment opportunity for those who want to invest in real estate to create wealth.

- HUDA Scheme offers facility of payment in Installments. 10% Payable at application, 15% within one month of allotment and balance in Six equal Annual Installments.

- Interest @5.5% per annum on the amount of earnest money for period beyond six months of closing date of scheme if the draw is not held and earnest money not refunded within this period.

- Allotment will be made through draw of lots.

- Any Individual can apply under the scheme provided he has not been allotted a plot of land directly by HUDA in the concerned Area. If you want to apply under reserved category, you must be a domicile of Haryana.

Concerns on the Scheme

- You earnest money could be stuck with HUDA for as long as Six months without interest and thereafter @ 5.5% p.a. interest.

- Development on Delhi-Mathura Highway and completion of Badarpur Flyover/ Access to metro is the key to next phase of price appreciation in the region and any delay on this front can take the sheen away for the investors.

- Faridabad is grappling with pollution like other NCR regions. All the areas of the Faridabad including residential areas, industrial areas and silence zone are in the grip of air pollution. A part of it can be blamed to its initial planning as an Industrial township. Even the quality of water is a area of concern as a recent study has found water levels to be highly polluted and unfit for drinking.

Conversion of Marla in Sq. Mtr., Sq. Yard and Sq. feet

Since the HUDA brochure talks in terms of Marla , you can refer the table below to see the equivalent size of plot in various dimensions

Download HUDA Application Form (remember to include additional Rs.100 while preparing the earnest money draft if you are using the downloaded version of application form)

Download HUDA Scheme Brochure

Last date of Application : 05-01-2010

Update : 04-01-2010

The Last date of Application has been extended to 06-01-2010

Read More!

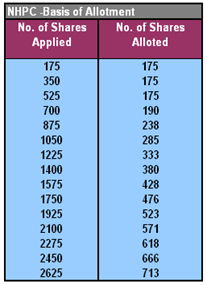

NHPC IPO allotment status is out. Click

NHPC IPO allotment status is out. Click

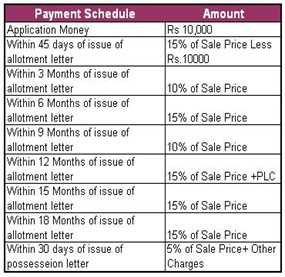

After Tata Housing, its the turn of National Buildings Construction Corporation(NBCC) Limited to launch affordable housing scheme. NBCC has launched “NBCC Town” scheme at Khekra on Delhi – Sharanpur Highway. 19 Km Away from the ISBT, the flats start at a price of 6.75 Lac for One Bedroom Flat (493 Sq. ft.) at 4th Floor of Lotus Apartments. The scheme opens from 25th August,2009.

After Tata Housing, its the turn of National Buildings Construction Corporation(NBCC) Limited to launch affordable housing scheme. NBCC has launched “NBCC Town” scheme at Khekra on Delhi – Sharanpur Highway. 19 Km Away from the ISBT, the flats start at a price of 6.75 Lac for One Bedroom Flat (493 Sq. ft.) at 4th Floor of Lotus Apartments. The scheme opens from 25th August,2009.

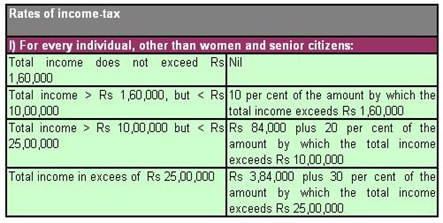

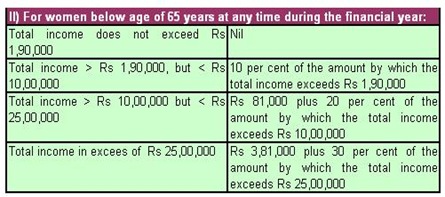

I was recently discussing with a group of friends that the Indian tax rates structure needs a definite shift if the government wants voluntary compliance of tax laws and wants to increase the number of tax payers in the country. One of the discussion points was that government should introduce single tax rate of say 10% on the taxable income for individual tax payers and should do away with so many slabs and deductions. One suggestion was that income beyond 5 Lac should be taxed at 10% with no rebates or deductions whatsoever.

I was recently discussing with a group of friends that the Indian tax rates structure needs a definite shift if the government wants voluntary compliance of tax laws and wants to increase the number of tax payers in the country. One of the discussion points was that government should introduce single tax rate of say 10% on the taxable income for individual tax payers and should do away with so many slabs and deductions. One suggestion was that income beyond 5 Lac should be taxed at 10% with no rebates or deductions whatsoever.

![[Mhada1[4].jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjSl2L1u-dGhTG2obBnObLTN5NZSr4rh2AmvUv_IkYupyIu6tSTyoMV7rqh5q8NnnIPhLazCRfrDWfDZk2F991SFhESP6CtIzi_gMKrRo4J43dM264g3nTwFQSySzfi-9jH6Nw/s1600/Mhada1%5B4%5D.jpg)