New Code aims to make tax laws and rates, Tax payer Friendly

And here comes the New Direct Tax Code Bill, 2009 which attempts to simplify the lives of the tax payers. Though the bill does not fulfill the wish-list of our discussion, it is surely a step towards providing a more tax-payer friendly and simplified tax structure.

Following are the brief highlights of the New Direct tax code Bill,2009

- The objective of the new tax code is to establish an efficient , effective and equitable direct tax structure in the country.

- All direct taxes like Income Tax, Dividend distribution tax (DDT), Fringe benefit tax (FBT) and Wealth tax will be covered under this single tax code.

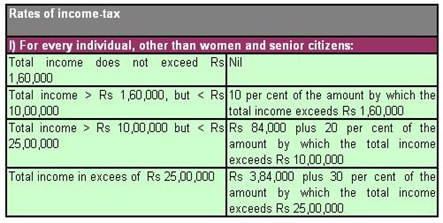

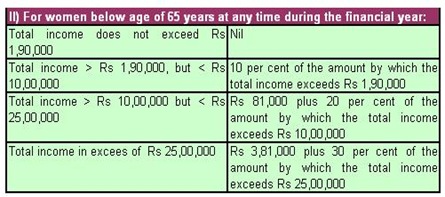

- New Tax Rates will be applicable w.e.f. Financial year 2011 as under

- Savings will now be taxed on EET basis. This means that Savings when done under designated schemes would be exempt from tax in the year the saving is done (First ‘E”). It will continue to be exempted together with the accumulations/accretions till the time they remain invested (that means till they are not withdrawn, this is Second ‘E’). The savings will be taxable at normal tax rates in the year in which withdrawal is made (this is ‘T’).

- However, accumulated balances as on 31st March,2011 in the Provident Fund will not be taxed.

- Deduction on account of savings has been increased from current 1 Lac to 3 Lac. However, since the new code doesn’t mention deduction in respect of Housing loan, the same may go.

- Dividends will continue to remain tax free in the hands of Investors.

- Capital Gains would now be taxed as income. The concept of short term and long term capital gains has been removed from tax perspective. Indexation benefit would be available on asset held for more than one year.

- The indexation base has been changed from 1981 to 2000.

- Since all capital gains are now taxed, Securities Transaction Tax (STT) has been abolished under the new tax code.

- Salary received in form of perks, perquisite, LTA, Rent free accommodation, Medical reimbursement will now form part of Income and will be taxable.

- Wealth Tax has been Re-introduced. Net Wealth in excess of Rs. 50 Crore will be taxed @0.25%

- In addition to deduction of Rs 3 Lac for notified savings schemes, Rs 15,000 deduction will be available for Medical Insurance Premium for self and family , and another Rs 15000 for parents. Up to Rs 50,000 can be claimed as deduction for treatment of disabled dependant , Rs 40,000 for prescribed diseases. Rs. 50,000 deduction would be available to handicapped and Rs 75000 for person with severe disability.

The New tax code is in discussion stage. You can give your comments and suggestions on the same by writing an email to directtaxescode-rev@nic.in

Keep a watch on this blog for posts related to implications of new tax code.

Download Discussion Paper

Download Direct Taxes Code Bill, 2009

8 comments:

Hi Rajesh,

Thanks for summarising the features of new tax code. However, it is still not clear what is the net net impact on an individual tax payer who has income from salary, capital gains, house property and interest income. Is the new code beneficial or neutral for such an individual ? Would appreciate if you can bring this coparison in your post.

Thanks

Kaushik

The same had happened in the yr 1995. Even then they tried to change the Tax Laws But nothing happened. Finally after 7 years of Debate only a few of the provisions of the new proposed Bill were chosen and they were incorporated in the Existing Income Tax Act 1961.

I agree with the comments above. It is just a proposal and let us not make any castles in the air right now.

I think this is a very revolutionary step taken by manmohan singh government and it is going to simplify the tax structure. However as you rightly pointed the tax slabs should be improved further to bring honesty among the people to pay taxes voluntarily.

Hello Rajesh,

Thank you for such a good article about the new direct tax code. I would like to point you that proposed tax code is not meant for the low end people. It is going to end the tax exemption on most of the long term savings. Do you think that it is good for the country like India which has the people with habit of saving for the future.

I am looking for your opinion. Thank you for the article.

Thanks,

Krishna

The tax man is commng.

Analysts recommends about the market on the basis of the market trends. Epic Research also have a big team for market recommendation who gives best trading tips.

Interesting insights on the New Tax Code 2009 It’s always fascinating to see how policy shifts can impact investment decisions. Just like choosing the right Builder in Noida navigating tax changes requires careful evaluation and trust in long-term benefits. Appreciate the clarity in this post keep them coming

Post a Comment