The DDA Housing Scheme 2008 has attracted about 3.5 Lac applicants for the 5010 flats put for sale. DDA had a dream run in terms of money collected on Application forms and will earn a interest of about 45 crores in the 3 month period on the Registration amount collected from the applicants. The lottery draw will be held in the Month of December.

Result of Allotment

The results of the draw shall be displayed on the Notice Board of DDA at Vikas Sadan, D-Block, INA, New Delhi-23. In addition the result shall be displayed on the website of DDA with the address http://www.dda.org.in. The result will also be published in the leading national Newspapers.

Allotment Cum Demand Letters will be dispatched through Speed Post/Courier/Registered Post

Waiting List

A separate waiting list of 200 applicants will also be declared in order of priority. The waiting list will be valid only for 9 months from the date of issue of demand letters. The registration money of the wait listed registrants shall be refunded along with unsuccessful registrants. However, before going for the draw in case the same takes place for filling up the vacancies, all such eligible wait-listed shall be asked to deposit the registration money. 15 days time shall be given to them to do so and only those names shall be included who would be depositing their registration money prior to the draw. A draw will be held only once after six months, from date of issue of demand letters, for allotment of the surrendered flats to the wait listed registrants as per the priority decided initially. Only those flats which are surrendered within six months from date of issue of demand letters would be included for allotment to waitlisted registrants. The waiting list is created just to ensure that the surrendered flats (if any) are allotted to same registrants rather than keeping them vacant and the list will be valid only for 9 months, hence it doesn’t create any right of the wait listed registrants if they fail to get a flat from the surrendered ones. If successful, the cost would be the cost of the flat on the date the demand cum-allotment letter is issued.

Interest on Registration money

In case registration money is not refunded within three months from the closure of the scheme, in case of unsuccessful applicants, simple interest @ 5% will be paid on the registration money for the period beyond three months after the closure of the scheme up to the last date of the preceding month in which refund has been made.

Can I surrender my Flats on allotment ?

The successful applicants shall have the options to surrender the flats before the issue of the possession letter. Flat will be automatically cancelled in case payments are not made within the prescribed period. No show cause notice shall be issued for the purpose. In both the cases, amount deposited is refundable without any interest. However, cancellation charges shall be recovered

How to check DDA Flats Draw Results and Application Status ?

Step 1. Go to the DDA Website by clicking following link

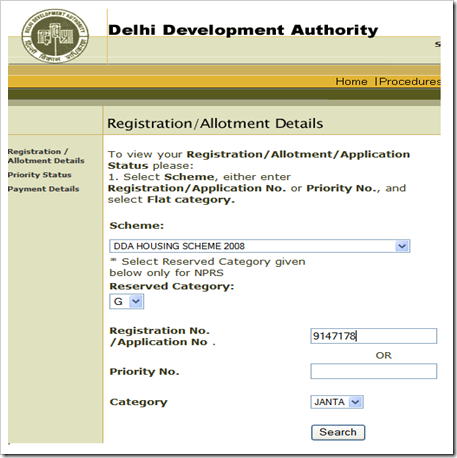

Step 2. You will see the following screen.

Select the Scheme and Reserved Category as shown above and put your Registration number or Priority No. and Category of Flat.

Click Search and see the Status of your application. Please not that the draw is expected in later part of December,2008.