The mood are bullish and the traders must be partying this weekend with the sensex rising to its all time highs amid bouts of volatility in the last week. The sensex closed at 13295 adding the valuable 165 points to its tally during the week. When I say valuable, it has a meaning, its not just an adjective to decorate my post. This addition to sensex has a lot to do to demonstrate that the energy levels in the markets are still high and we have a way to go before reaching the crossroads. This rally has also underlined the strength of the India Inc. which was visible the Q2 earnings show.

The mood are bullish and the traders must be partying this weekend with the sensex rising to its all time highs amid bouts of volatility in the last week. The sensex closed at 13295 adding the valuable 165 points to its tally during the week. When I say valuable, it has a meaning, its not just an adjective to decorate my post. This addition to sensex has a lot to do to demonstrate that the energy levels in the markets are still high and we have a way to go before reaching the crossroads. This rally has also underlined the strength of the India Inc. which was visible the Q2 earnings show.Let’s look at some of the factors that may provide insight into the way markets are likely to drive in the coming days.

Q2 results were sizzling !

Yes, it was a pretty impressive show put up by the India Inc. Indian companies saw robust growth both in terms of the topline (Sales) and bottomline (Profit) with positive guidance on the coming quarters. The bright thing in the whoile story was that a good chunk of Mid companies have also reported a terrific growth and have helped to lift the overall sentiments for the markets . This is in contrast to the rally seen in the month of July and august which was primarily driven by large caps.

Read out few success stories of India inc.. in Q2 in the print Media. DNA reports that the GDP and industrial production growth figures had broadly confirmed that the economy continues to grow at a healthy pace

Financial express reports that India Inc demonstrated superior performance, that too in the toughest quarter of the year. Most industries usually saw a cyclical slackness due to the monsoons and a general slowdown in the second quarter. An aggregate of 435 companies, whose results were analysed by FE, showed that these companies posted a 32.4% rise in net profit over the same period last year. Sales grew to Rs 1,66,295 crore during the quarter ended September 2006. This represented a 31.4% over the same quarter in the previous year.

Economic times in its story “India Inc. bottomline hits the roof” reports that its analysis shows that India Inc is improving its margin through cost rationalisation and better pricing. This is unlike last year, when lower interest costs and tax rates had to compensate for the fall in operating margins for maintaining the PAT margin.

The Q2 results have been able to revive the investor confidence in the recent rally and has led big players to revise their targets for the Indian companies, which eventually lead the way for sensex to put up a bold face.

FII’s continue to buy India story

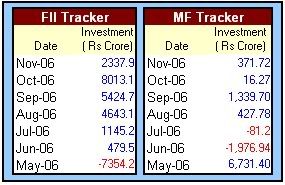

FII’s continued to be net buyers in the month of November. They have bought around 2338 crores till now in November. See the Chart below for Net Investment pattern of FII since after the May debacle and the story would speak for itself.

Mid Cap stocks get re-rating

The Q2 results also brought a respite to the mid cap stocks that were laggards in the earlier phase of the pullback. Select Midcap stocks which had delivered strong results were stocked by the investors. The trend is expected to continue as these stories unveil and as these companies roll their future plans.

The Road Ahead

Look at the graph above and you can experience the pleasant ride from the lows of May to the highs of November. The technicals are placed in positive zones and are not sending any negative signals.

Investors may expect the markets to continue its ride toward the new horizons. However, we may see more volatility in the coming days as some investor groups may tend to book profits on every rise rather than leaving everything on the table. The broader market sentiments are positive and 13500 on sensex would be the next level to watch and we are just 205 points way from there!

Happy Investing !

1 comments:

hey Rajesh tnxxx for dropping by my blog!

WOW u seem to be an INVESTEMENT GURU for sure! :)

Keshi.

Post a Comment