Stock : Aksh Optifibre

CMP : Rs 41.90

Risk : High

Outlook : Negative

I am sure a lot of Investors are dying to see something on this stock. This stock which was a turnaround attraction in the year 2004 and again in the year 2005 had not been able to deliver returns to its shareholders in terms of both delivering on its promises of high growth and creating shareholder wealth.

Investment Guru blog had also recommended the stock on November 26th, 2005 classifying the stock as a strong turnaround candidate and strong business outlook. This blog carried a short term tag of 90 and long term tag of Rs. 120 for the stock. The stock, though delivered its short term target, failed to keep up its commitment of strong growth and has been a laggard since then. I have been getting lot of queries from the visitors too, to write a review on this stock. I know the news is not good for the investors but let us take a hard bite on this and see what's this stock is up to.

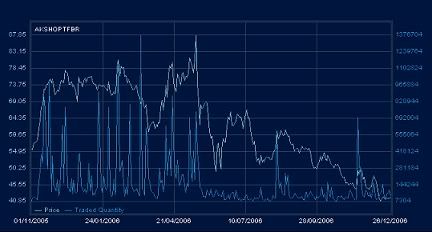

Returns to Investors

You can make out from the above chart that this stock has been a continuous laggard for the whole year and is currently trading near to its 52 week low of Rs. 39. The stock was trading at Rs . 41.90 as on 26th December,2006. The volumes have also followed suit with spikes at certain intervals, which however didn’t resulted in impacting the price positively. On an overall basis the stock has eroded the investor wealth by 53% within the last one year.

What went wrong with Aksh Optifibre ?

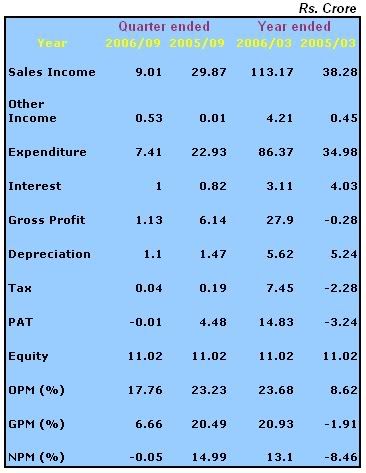

I do not have a copy of the annual report of the company. However from the summary of the results shown in the table below, the company has failed to deliver on the promises of strong growth backed by strong order book and 50% capacity expansion to meet the projected growth. So what went wrong with the company’s plan? I think the answer needs to come from the company’s chairman. I had written an email to the company secretary, asking him to clarify certain questions on the performance of the company, however there was no response from their side.

Sales down Sharply

The company’s sales for the quarter ended Sep’06 are down by 50% over the previous quarter and down 69% over the quarter ending Sep’05.

From profits to Losses

The company’s operating profits were down 6% versus Sep’05. The net loss was 0.05 % as compared to a net profit margin of 15% in Sep’05.

Shareholding Pattern

As of September ’06, the shareholding pattern looks as follows :

Promoters : 30%

Mutual Funds : 8%

Non-Institutional

Corporate : 12%

Individuals : 41%

Others : 9%

From above we can make out that a large chunk of the stock is in hands of the public. FII’s hold only 9000 shares in the company (One Investor). This shows that the stock’s price movement will depend on large extent to the its ability to draw FII attention . However the possibility of same looks bleak.

Slew of announcements

Foray into IPTV

The company in association with MTNL on October 17, 2006 has announced the launch of India's first IPTV Service in Delhi. The Service will offer traditional television broadcast, video and Music on demand and video calling TV facilities. However, the ability of the company to deliver in this new initiative is questionable.

Amalgamation of Aksh BroadBand Ltd.

The company is considering amalgamation of Aksh Braod band Ltd. With itself.

Issue of Fresh Equity

The Board of Directors of the Company on December 05, 2006 has passed a resolution by circulation recommending for the issue of fresh equity / ADRs / GDRs / FCCBs / Convertible Bonds, in the domestic market and / or International Offerings through Public Issue, Rights issue, Preferential issue and / or Pvt Placement with or without green shoe option to the extent of USD 30 mn with a green shoe option of USD 4.5 mn, subject to approval of shareholders to be obtained by means of Extra-Ordinary General Meeting of the shareholders of the Company to be held on January 06, 2007.

Outlook on the stock

After reviewing the company’s performance and its stock price movement , Investment Guru is of the view that Investors should not expect much to happen on this counter. Though the stock is quoting near its 52 week low, the chances of a speedy recovery doesn’t exists. The company has to deliver better results and revive confidence of the investors in order to move its stock price upwards.

5 comments:

Hello rajesh,

First of all thanks for giving an much awaited advice on aksh optfibre.Now rajesh what will you suggest?I have 1000 shares of aksh should i remain invested or should i move out and enter into some other stock,if possible give some idea where to invest.

Thanks alot.

Raman

Dear Rajesh

Thanks a lot. I was tired looking for an update on Aksh. Unfortunately, I have recently bought 300 shares at price of Rs. 45. Please advice if I will be able to get my price back or should I book loss and invest in some other stock.

Ashish

Thanks you so much Rajesh for the update. I will get out of this stock immediately.

Can you also update GE Shipping after it's demerger?

Thanks again,

Amit.

Excellent review

Thank you for this great information.

Post a Comment