Last week the sensex continued its upward journey to close 105 points up at 12237. Now we are just 435 odd points away from the lige time high of sensex. The heart beats have started rising and a wind of confusion is blowing in the dalal street with regards to the direction of sensex. So the million dollar question is " Whether the sensex would start falling now since it has nearly reached its previous peak "?

I know this question is not a new to the investor's mind. This question was buzzing all through the sensex journey from 10000 levels till the final landing at 12670. So what's new about this question ? The new things friends is that last time the question was being asked with curiosity and a mix of enthusiasm as every tom dick and harry was floating with profits on the table. Now the tone has changed.

I hope you guys would agree with me that this time the question remains same but the tone is that of fear and pessimism. People are awaiting a big fall to happen. why ? ..ummm..may be because the sensex had a great fall around these levels last time in May and they fear the repetition of the same...ummmm..may be because the wounds of the may blast are still green...may be they don't want to take a chance this time..may be the so called prophets of stock markets, whose mouths were tight lipped during the May fall cos they were jumping with recommendations just ahead of the fall and then came the wind which blew away so strongly that it shook the confidence of even the experts, are giving cautious guidance because of the same reasons...the list is endless! Let's leave the past behind (but not ignoring it) and sneak though the telescope of Investment Guru to understand what lies ahead..

The Technical aspects

Sensex is trading well ahead of its 100 and 200 days moving average and as currently there are no signs of a strong trend reversal. However as the sensex moves ahead of the 100 DMA without smaller bouts of corrections, the probability of a sharp fall increases. In summary we still have some way to go up before coming down. Smaller corrections should be a welcome move.

The next triggers

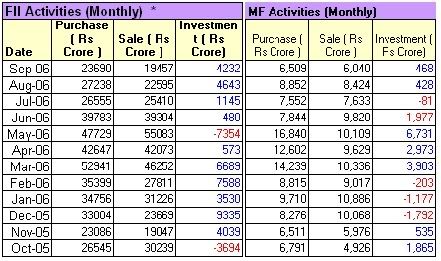

FII's continue to be on the drivers seat and yes they have been driving it all through the month of July,2006. Let's take a look at the FII activity for past few months.

Wow! Have you noticed that FII's have sold Rs. 7354 in equities in the month of May and have been continuous net buyers since then and they have already bought much more than what they sold in May-06. FII's have bought net equities to the tune of Rs. 10500 crore since June,2006. Mutual funds are still not a force to reckon and sitting on sidelines. They actually sold in June -06. Poor fellows ! Since they burnt their fingers in May-06 mutual funds have been cautious buyers in equities and have been sellers on every rise. They are still sitting on a good amount of cash. So what are they waiting for ? God knows !

Q2 results season is set to roll and generally is a better quarter for companies. So will the Q2 results play a big role in sustaining this market rally or will they be the leaders in pinning this baloon ? If Q2 results are not as per markets expectations, that would surely be a good excuse for markets to drag down, but the probability of this happening is less given the strong growth momentum in Q1 which is expected to continue. Q2 is more important in terms that it will bring more visibility to the yearly guidance of companies.

Large Caps Vs. Mid caps

There is a section in the analyst which believes that large caps have become overvalued and its time to shun them and hunt for good quality midcaps. Investment Guru however believes that though the large caps were the ones to bail out the markets, they would continue to be investors favorites. Midcap stalwarts have been a steady performers in last few months and they should also be picked equally carefully as they are first to bear burnt of any downfall.

To summarise

A prudent investor would play this market carefully realizing that the markets are heading towards their earlier peaks. He would keep booking profits at regular intervals and would stay away from penny and worthless stocks. Again long term investors would not worry for short term movements and keep their faith intact. Remember, there are two factors that differentiate between a rational and irrational investor, Fear and greed, A prudent investor would neither buy for greed nor sell for fear. A prudent investor turns out to be winner and smiles his way to the bank. So be a prudent investor and take your call on the markets. We would countinue this wonderful journey together !

1 comments:

Dear Sir

I have buy 50 shares of Reliance industries at 1005 on your recommendation in Investment idea article. now the share is crossed 1170. please advice if i sell or hold this stock

Ankur

Post a Comment