Royal orchid hotels has eneterd the capital market with a initial public offer of 68.2 lac shares on a book building basis in a price band of Rs150-165.

Royal orchid hotels has eneterd the capital market with a initial public offer of 68.2 lac shares on a book building basis in a price band of Rs150-165.Investment Guru recommends investor to subscribe to the public issue. The issue not only offers handsome listing gains, but can also be hold for a medium term perspective. The hotel industry is in limelight and is expected to outperform in the near future. Royal orchid has an advantage of having hotels at prime locations in the happening city of bangalore and mysore and planning to expand in high demand cities of hyderabad and Pune.

Company & Issue highlights

The company belongs to Baljee group and operates 3 hotels in Bangalore & 1 in Mysore.

The company propose to use the issue procedds to expands its hotel chain to Hyderabad, Pune & Bangalore.

The company is focussing on the happening cities in India where the room occupancy and room rates are high. The business is less dependant on tourism and more on the business travels in these IT cities. The demand for hotels in these cities is expected to remain robust.

The company reported a profit of 12.98 Crore on a turnover of 58 crore for FY2005. However for the First half of current year, the profit zoomed to 8.56 croreson a turnover of 35 Crores.

Based on FY05 EPS of 7.10, the issue price works out to be at P/E multiples of 23. The peers are currently valued at a P/E range of 20-30.

Issue details

Opens: January 12th,2006

Closes : January 17th,2006

Registrar : MCS Ltd.

Retail Investors: Rs.1 Lac

10 comments:

Hi rajesh,

Thanks for the update (after long time seeing an IPO update on this blog). I like your style of writing ewhich is a mix of simplicity and power pack information.

Please keep up your good work.

Mohit singh

Jaipur

I am coming to this blog since July 2005 and has benefitted tremendously with Mr. Soni's Ideas. I have high regards for him and agree with Anil's comments that he is doing a wonderful job.

It has become a habit now to check his blog regularly.

SS

Hi Rajesh

Is still still ok to buy Reliance Industrial Infrastructure ? If yes, what is the target price ?

Please advice.

I have already invested in nitin spiners ipo.Ihave only 1.5 lakhs left with me so amogh these in which i apply in what proportion for maximum gains

1.Royal orchid

2.Raj rayon

3.andra bank

4.bob

5.sakthi paper

6.dynemic products

7.Guj state petro

8.Dainik jagran

is bandhitters(.)com site good for short term picks?

Hi Rajesh,

What are your viws on nitin spinner IPO? I have invested 40 K in this IPO. ALso out of current IPO's , which are worth applying inaddition to Royal Orchid IPO that you mentioned.

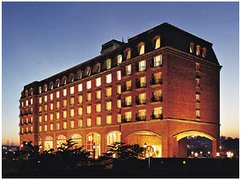

The hotel looks good :)

Hi Rajesh,

I totally agree with Anil and others that u r doing awesome job. Keep it up.

I also bought 150 shares of Guj Ambuja and holding it as it seems a good long term bet.

Can you please provide your valuable inputs on

1. IDFC

2. Aditya Birla Nuvo Ltd (Indian Rayon)

3. Mcdowel

4. Mahindra & Mahindra

I am looking to invest for atleast 12 months span. How wld you divide your 1 Lac in to above scripts?

Please help as you always do...

Thanks...

Supal Patel

Pune

Investor Forum Blog Update

IPO Scan of Raj Rayon now available.

Log on to http://investorforum.blogspot.com

Investor Forum Blog Update

IPO Scan of Raj Rayon now available.

Log on to http://investorforum.blogspot.com

Thanks for keeping up the good work.I will like to know ur take on reliance.Just if you can give some insight as whether to enter into this stock at 870-930 or to sell it off.This is a important stock and ur comments will be interesting and most welcome.

Best Regards,

Ashutosh.

Post a Comment