CMP: 65.85

Industry: Jewellery, Diamond, Retail & Lifestyle

Book Value Per Share : 209.58

EPS : 16.92

Market Cap: 560.14

What makes Gitanjali an attractive Investment ?

- The stock is currently quoting at 0.31 times its Book Value.

- Current EPS of 16.92 coverts into PE multiple of 3.89 which is significantly lower than Industry average of 5.1 considering strong brand presence of the company

- The stock also Offers a Dividend Yield of 2.73% in addition to attractive valuation.

- India continues to be one of the world’s largest consumer market for Jewellery and Gold.

- India and China are considered to be fastest growing consumer market for diamond jewellery and this provides Gitanjali a reasonable offset to ongoing recession in world’s major economies.

- Diamond jewellery is fast emerging as new social trend leaving behind old preference for plain Gold Jewellery.

- The company’s foray into Infrastructure (primarily Gems and Jewellery SEZ’s), Lifestyle Products such as Watches and fashion accessories would offer diversified sources of Revenue to the company.

- The company has aggressively followed its strategy of growth with acquisition which has helped it to expand its distributional capabilities.

- The company has a healthy mix of income from Exports as well Domestic segments.

Risk Factors

- US is the largest consumer of retail diamond jewellery (48% of world’s consumption) and largest export market for gems and jewellery for India, the ongoing recession would have impact on export earnings of the company.

Latest News on Gitanjali Gems

Sebi has issued an order granting permission to the promoters of Gitanjali Gems to Buy Back 1.2 Crore shares of the company at a price up to Rs. 120 per share without making public announcement of the same. This move would increase Promoter’s stake in the company from existing 54.19% to 63.09%.

Investment Guru is of the view that the stock has good potential to move up from current level. The proposed Buy back of shares by promoters would also act as a short term trigger to the stock price.The reduction in the stock price may happen on account on general fall in market, but this risk stands good for any stock being traded in the market.

Gitanjali Gems – Detailed Info

Shareholding pattern of Gitanjali Gems

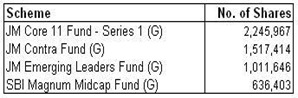

Mutual Fund Holding Gitanjali Gems

Financial results – Quarterly Comparison

This stock was discussed earlier on this blog here

11 comments:

Good to see a review after long time from the Investment Guru : )

Buy Buy...short term target of Rs. 100

How has the company done in Q3...has it maintained its sales and profit ...could you highlight on this as this will indicate the impact of recession on the company.

does any body knows if gitanjali gems had hedged its foreign currency exposures ?

Boss...the stock is up 10% ...I am holding on the 200 shares I bought on monday..planning to exit at 80 and again enter if it continues going up!

Another positive for this company is that the valuation of its inventory of gold and diamonds has shot up significantly and this is not built in the valuations yet.

Boss...maan gaye...the stock is up 31% ...I am planning to sell 100 shares (kuch to jeb mein aaye)...will hold on to rest for some more time.

Good Analysis !

The Indian stock market is very diverse indeed.

As rupee is getting stronger day by day, exporters will be at loss. Also dollar is towards slope against many currencies.

Taking this into contribution I feel one should not invest in companies which are export oriented.

Thanks

Alliance Research

http://www.allianceresearch.in

I Found this blog very informative. keep writing.

Equity tips free trial

Post a Comment