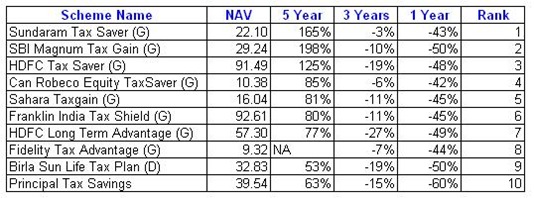

The Taxman is calling again and investors are finding it difficult to decide if they should invest in a ELSS or not. Last Year has been a year of erosion of the NAV’s of the mutual funds and Tax Saving Schemes were no exception. Investors are not sure if they would get positive returns from Mutual funds. However, if you think from an Investment perspective of Three Years (lock-in period for ELSS investments), I would suggest that this is perhaps a good time to invest for a long term. Here are the Top 5 Funds based on their performances -

However, one would see a return back to old favorites like PPF and FD’s and even NSC’s this time around. The lure of equity markets has surely taken a backseat and safety of capital has come to forefront of Investors. Investment Guru is of the view that ELSS still would emerge as a high return asset class for Tax saving purpose from the current levels and hence investors may consider allocating a part of their tax planning kitty to tax saving mutual fund schemes.

7 comments:

I have invested in PPF as it is a safe option. The way Mutual funds have tumbled (almost 60-80% down), it leaves little confidence in them.

Hi Rajesh,

Is the amount I receive on redeeming these units tax free ?

Thanks,

Prakash

HI Rajesh,

You have not listed ICICI prudential in the list. Is it good or not? I have invested but it is not performing good. Last few days I have seen the NAV value is increasing in maximiser fund. So Planning to keep it for some more time. or should I choose any other fund? Do you have any idea about that?

Tax Planning for 2009

Thanks,

Krishna

Hi

Is money invested in Elss is safe.

What is the risk.As almost NAV value has decresed in all the funds.So how safer is to invest in elss.

To many taxes.

The number of tax saving mutual funds have increased making it difficult for me to choose the one that suits my budget.

Loovely blog you have

Post a Comment