Company : Mahindra & Mahindra

Sector : Automobiles

CMP : Rs. 730

12 Months Target price : Rs. 1050

Risk : Moderate

About the Company

Mahindra & Mahindra Limited (M&M) is the flagship company of US $ 2.59 billion Mahindra Group, which has a significant presence in key sectors of the Indian economy

M&M has two main operating divisions:

The Automotive Division manufactures utility vehicles, light commercial vehicles and three wheelers.The Company has recently entered into a JV with Renault of France for the manufacture of a mid-sized sedan, the Logan, and with International Truck & Engine Corporation, USA, for manufacture of trucks and buses in India.

The Tractor (Farm Equipment) Division makes agricultural tractors and implements that are used in conjunction with tractors, and has also ventured into manufacturing of industrial engines. The Tractor Division has won the coveted Deming Application Prize 2003, making it the only tractor manufacturing company in the world to secure this prize.

Rural push to drive farm equipment growth

Mahindra is a market leader in the farm equipment segment. M&M has two main tractor manufacturing plants located at Mumbai and Nagpur in Maharashtra. has a strong and extensive dealer network of over 450 dealers for sales and service of tractors and spare parts.

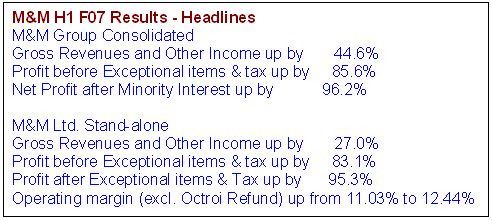

In FY06 the company commanded 29.7% of the market share. The domestic tractor industry registered a healthy growth of 39.9% in the second quarter of F2007 over Q2 last year. The company sold 21,801 tractors in the current quarter as against 17,096 tractors in Q2 F2006. The company’s exports registered a growth of 64.1% while the Engine business clocked a growth of 78% in Q2 FY07.

The Farm sector as a whole is bound to reap huge benefits with the UPA government’s thrust on rural development and prime minister pledge of reforms with human face. Favurable monsoons would also be a boon to the company. With the background set for rural thrust , M&M is all set to make sure that its tractors and farm equipments rule the Indian soils.

Automative Sector: Scorpio runs the show

In FY 2006, the company continued to dominate the utility vehicles segment with the market share of 47.6%. The Scorpio continued its strong performance in the market with a 20% improvement in volumes over Q2 last year. The Bolero variants also witnessed good growth. The Company remained the market leader in the UV segment with a share of 45.7% in the second quarter. The market shares has registered a decline as compared to Fy06 due to competition from Toyota Innova.

In the 4MT LCV segment, the sales of Mahindra vehicles increased by 5.7% to 1,991 against a 4.4% decline in industry sales. The Company had a market share of 19.3 % in the quarter as against 17.44 % in Q2 last year.

In the large 3-wheeler segment, while the industry volumes declined during the quarter by 19.6%, however the company’s volumes declined by only 13.8%.

The Company’s vehicle export saw a strong growth of 51.5% with the Company exporting 2,761 vehicles in Q2 F2007 as compared to 1,822 vehicles exported in Q2 last year. This is the highest ever quarterly vehicle export volume for the Company.

Investment guru is of view that Scorpio would continue to run the show for M&M, while the 3-Wheller segment would make a further dint. However, the silver lining would be company’s major thrust on exports and this would keep the flag high.

Subsidiaries to boost Valuations

Tech Mahindra –Feather in the Cap

M&M has around 46 % stake in Tech Mahindra. Tech Mahindra has grown rapidly to become the 8th largest software exporter in India. The company stock had a dream run in the last few sessions and analyst are counting heavily on the company reach and expertise in the Telecom arena. The growth of telecom industry will further boost the fortunes of Tech Mahindra and in turn will increase the valuation of its Parent, Mahindra & Mahindra.

M&M Financial Services –Strong Networking

M&M hold around 68% stake in M&M financial services which is the financing arm of M&M. It provides loans to fund purchases of UVs, tractors and cars, with a focus on India’s rural and semi-urban territories. The company boasts of a storng branch network and has a pan India presence. For the half year ended Sep,2006 the company has posted a 40% growth in Net Income while net profits grew by 19%.

Infrastructure – Reaping Dividends

M&M has a presence in Infrastructure sector though its subsidiaries Mahindra Gesco and a host of other subsidiaries. M&M holds 55% in Mahindra gesco. Besides three SEZs in Chennai, Jaipur and Pune, it is developing residential and commercial projects in cities like Mumbai, Pune, Chennai, Faridabad, Bangalore and Delhi.

Investment Guru is of the view that M&M has a sizeable stake in its subsidiary companies and these companies have posted strong results. The outlook for the subsidiaries is also bright and this would further boost the valuation of M&M. The benefits in turns accrues to Mahindra and Mahindra shareholders.

Valuations

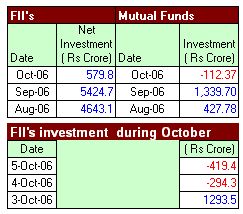

The stock is currently trading at Rs. 730 . At current price, the stock is valued at 19 times its FY06 EPS. However, if we take the current half year performance into account the stock trades at a forward PE of 17. FII's holding in the company share is 36.8%. Investment guru recommends investors to enter the stock with a long term horizon and enjoy the fruits of the success of M&M and its subsidiaries.

Additional Readings & References

Shareholding Pattern

Financial Releases

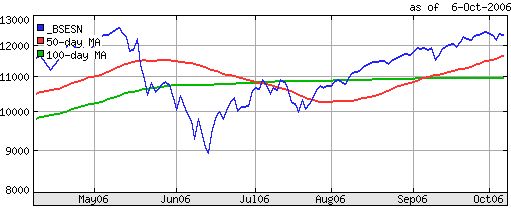

Stock performance

Tech Mahindra

M&M Financial Services

Mahindra Gesco Read More!