Too pricey to fit the bill – Avoid

Company : Jindal Cotex Ltd.

Issue Price : Rs. 70 – 75

Outlook : Avoid

About Jindal Cotex

Jindal cotex is engaged in the business of manufacturing of Acrylic, Polyester, and Polyester- Viscose, Polyester Cotton, combed and carded yarns, which are appropriate for apparels, suitings & knitted fabrics. Company has current installed capacity of 23,472 spindles for acrylic, cotton blended and polyester yarns. It manufacture and sell yarns under the trade name ‘JINDAL’.

Objects of the Issue

The Company is setting up a new facility to manufacture cotton yarn with a capacity of 28,800 spindles in Ludhiana in Phase I.

It will further add 21600 Spindles, Yarn dyeing facility and a Garment unit with capacity of 3000 pcs. per day in Phase II.

The company would use the funds to invest in Subsidiary Jindal Medicot which manufactures Medical Textile products. It would also invest in another subsidiary Jindal Specialty textiles which manufactures PVC Laminated products.

Financials

The company has put up an impressive top-line growth of 39% for year ended 31st March,2009. However the same momentum was not visible in the bottom line which grew only by 2.3% which suggest that operating cost increased in much bigger proportion.

Overall Assessment

The company is a again a classical case of greedy promoters who are asking for more than their worth. This a trend visible in Indian markets that as the stock markets gain momentum the promoters start flooding the capital markets with issue at a aggressive premium. I strongly believe that market regulators should do something about it in the interest of at least retail investors.

Coming back to Jindal cotex, the company is asking investors to invest at a Pre issue P/E of 20.23 at lower band and 21.68 at the upper band while the Industry average is just 9.10

Investment Guru is of view that investors should give this IPO a miss.

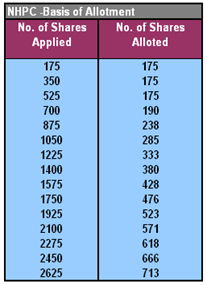

Read More! NHPC IPO allotment status is out. Click

NHPC IPO allotment status is out. Click

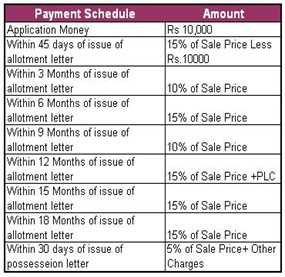

After Tata Housing, its the turn of National Buildings Construction Corporation(NBCC) Limited to launch affordable housing scheme. NBCC has launched “NBCC Town” scheme at Khekra on Delhi – Sharanpur Highway. 19 Km Away from the ISBT, the flats start at a price of 6.75 Lac for One Bedroom Flat (493 Sq. ft.) at 4th Floor of Lotus Apartments. The scheme opens from 25th August,2009.

After Tata Housing, its the turn of National Buildings Construction Corporation(NBCC) Limited to launch affordable housing scheme. NBCC has launched “NBCC Town” scheme at Khekra on Delhi – Sharanpur Highway. 19 Km Away from the ISBT, the flats start at a price of 6.75 Lac for One Bedroom Flat (493 Sq. ft.) at 4th Floor of Lotus Apartments. The scheme opens from 25th August,2009.

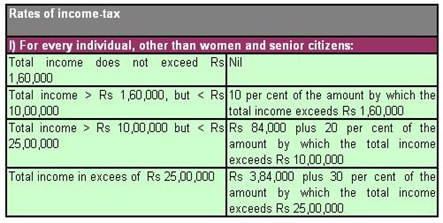

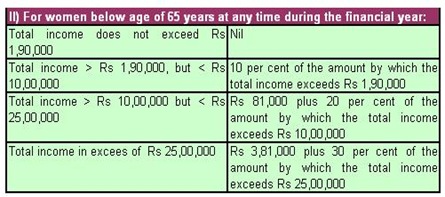

I was recently discussing with a group of friends that the Indian tax rates structure needs a definite shift if the government wants voluntary compliance of tax laws and wants to increase the number of tax payers in the country. One of the discussion points was that government should introduce single tax rate of say 10% on the taxable income for individual tax payers and should do away with so many slabs and deductions. One suggestion was that income beyond 5 Lac should be taxed at 10% with no rebates or deductions whatsoever.

I was recently discussing with a group of friends that the Indian tax rates structure needs a definite shift if the government wants voluntary compliance of tax laws and wants to increase the number of tax payers in the country. One of the discussion points was that government should introduce single tax rate of say 10% on the taxable income for individual tax payers and should do away with so many slabs and deductions. One suggestion was that income beyond 5 Lac should be taxed at 10% with no rebates or deductions whatsoever.