Q1 Results on watch-list, Monsoon disappoints, UPA allies play spoilsportThe sensex closed at 10510 down 99 points over previous week. And this has a message for Investors. Markets are yet not confident enough to take this rally forward and every rise in sensex is followed by bouts of profit booking activity.Let’s look at some facts which would help us indicate the future corse of action :

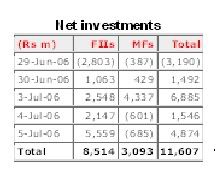

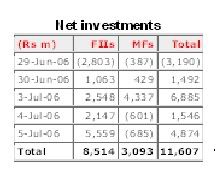

FII’s & MF’s were net buyers !Over the last week FII’s were net buyers to the tune of Rs. 8.5 Billion while the Mutual funds bought about Rs. 3 Billion.

Monsoon disappoints !

Monsoon disappoints !Markets had built hopes of timely arrival of monsoon. However, the rain gods have shown delay and this had disappointed the markets. The IMD ( India Meteorological Department) lowered its forecast of the southwest monsoon to 92 percent of long period average (LPA) from the earlier expectation of 93 percent. It however expressed bountiful rainfall in the month of July. The IMD annually gives two projections - an advanced forecast in April followed by another in the first week of July. The projections are important as July is a crucial month for agriculture sowing, particularly for crops like rice with two-thirds of the farm land dependent on rainfed irrigation.

UPA allies play spoilsportManmohan singh's government is coming under continous presuure from its allies specially over the disinvestment issues. The government has recently planned to put the divestment plans into cold storage, thanks to the rising clout of leaders like karunanidhi. The Neyveli Lignite drama was an example to this. There are rumors going around suggesting threats to stability of the UPA government. However, this seems unlikley.

Q1 Results to unfoldWith companies lined to announce their quarterly results, the stock specific action is expected in thier counters. However, results of companies like infosys would act as a short term trigger for technology pack as a whole.

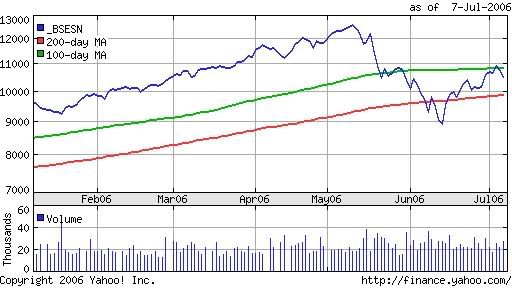

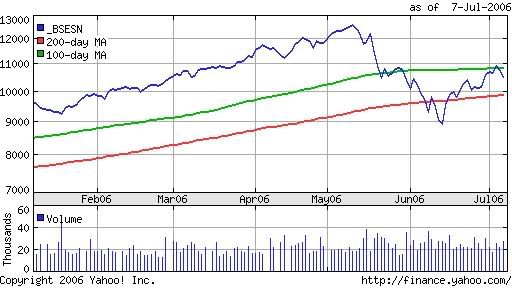

Going technicalI was just having a look at the technical chart of the sensex for the 6 month period and the results were sending a caution signal.

The Senxes is trading below the 200 as well as 100 day moving average which is not a good sign for the markets. This suggests that the pattern is still bearish at the macro level.

To summarise the above discussion, the markets are expected to be volatile in coming week with stock specific action. The broad indicators are showing downwards trend which means that every rise would result in profit taking and would stop indices from marching ahead. Large caps will continue to outperform their midcap counterparts for some more time. Hence Invetsors are advised to stick to fundamentally strong stocks.

In coming posts , I would talk about some mid cap stocks which look good investment opportunity with long term perspective.

Happy Investing!!

Read More!